Strong results also reflect positively on customers, the economy and society

2023 was an exceptionally strong year for ING Belgium with a profit before tax of €1.2 billion.

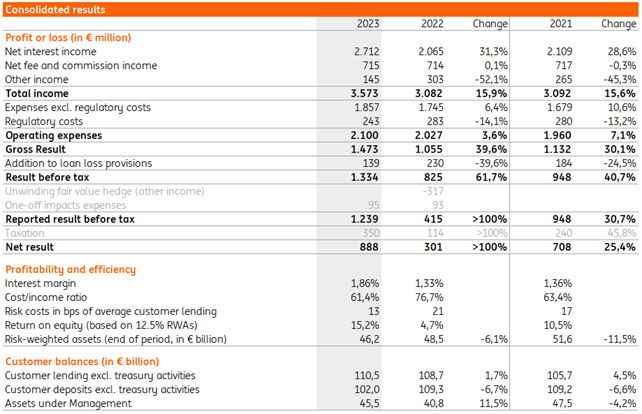

In 2023, ING Belgium recorded its best result ever. The bank realised a profit before tax of €1.2 billion based on €3.6 billion on the income side, supported by a favourable interest rate environment. Operating costs were kept under control at €2.2 billion and risk costs remained limited. This generated a strong result with a return on shareholders’ equity of 15%. These financial results allow the bank to take full advantage of its transformation role. ING does this by re-lending every deposit to the real economy, and by putting its capital to work: for every euro of capital, the bank provides €20 in loans. Our total credit portfolio grew to a total of €110 billion in outstanding loans to customers.

With a result before taxation of €1.2 billion, ING Belgium can look back on an exceptionally strong 2023:

Peter Adams, CEO of ING Belgium:

“Creating impact for our customers, our employees, our shareholders and the Belgian economy – that is what a bank like ING is all about. These strong results, with a solid return on equity, allow us to use our resources to the maximum extent and to have the greatest possible impact on the development of the Belgian economy as a whole. That deserves more attention in the debate. We are open for business!”

Strong income supported by favourable interest rate environment

With a total income of €3,573 million in 2023, the bank has seen its income increase by 16% compared to 2022. This increase can mainly be explained by the higher interest income, which totals €2,712 million. This was due to the higher margins on deposit products and in spite of the lower margins on credit products. The higher interest rates have enabled ING Belgium to make three rate increases in its savings accounts, making the interest rates on savings accounts among the most attractive in the Belgian market.

Commission income remained constant in 2023, ending at €715 million. The slightly lower income from insurance was offset by higher income from investment products.

Increase in operating costs remains below the Belgian inflation level

Operating costs amounted to €2,195 million and included €95 million mainly related to restructuring costs. If we, in terms of operational costs, exclude the one-off costs in both years, these increased by €74 million, or 3.6%. This was due to several factors, including automatic wage indexation. Nevertheless, the increase remains below the inflation level thanks to a continuous pursuit of operational efficiency within the bank.

The risk costs in 2023 ended at a moderate level and amounted to €139 million. That is €91 million lower than last year, when extra provisions were set aside for large companies exposed to Russia.

€15 billion in new loans support the ambitions of private individuals and companies

After the first six months of 2023, ING Belgium’s credit portfolio grew by almost €1 billion. In the six months that followed, growth continued, reaching a total of €110.5 billion of outstanding loans to customers.

Hans De Munck, CFO of ING in Belgium:

“By strengthening the profitability of ING Belgium, we are in an even better position to invest in services to our customers to further increase satisfaction. It also allows us to continue providing loans to meet the financing needs both of individuals and of businesses, while still offering an attractive and competitive return on their savings."

More loan solutions for each customer segment to support the energy transition

Over the past year, many families have had to shelve their plans to buy a home. The sharp rise in interest rates since 2022, combined with high property prices and a highly competitive market, resulted in weak demand for mortgage loans in 2023. Nevertheless, we see that the demand for renovation loans has tripled. The ING real estate study of 9 January 2024 also showed that an increasing number of families are open to the possibility of a home that requires renovation, and a poor EPC score is less and less of a deal breaker for buying such a property.

ING also pioneered the launch of the Sustainable Buildings Guide, an interactive tool that helps businesses and families on their way to improving the energy performance of their property. Today, the bank supports approximately 2,000 business customers in making their real estate portfolio more sustainable. For private individuals too, this innovation offers answers to the questions of how they can make their home energy-efficient and what it will cost.

Freedom of choice perpetuates further growth of digital channels

Making banking simple also remains something that is inextricably linked with the bank. This means, among other things, freedom of choice in how customers interact with the bank. In 2023, the branch network evolved into a smaller network of larger branches, with all expertise close at hand. The doors of the branch network were once again open in the mornings without the need to make an appointment. In addition to expertise via a branch, digital channels remain an important link. The chat function was running at full speed, with an impressive 50% more customers being helped via that channel by a member of staff. Of all the questions that come in via chat, the ING Digital Assistant (IDA) took care of half. Compared to the same period last year, IDA handled five times more questions.

The efficient service that ING Belgium aims to provide also translated into commercial services. For example, customers bought almost 73% of the products that are available digitally via the ING Banking app or on their computer, an increase of more than 12% and the highest figure ever for the bank. If we look at the app alone, it is actually an increase of over 34% compared to last year.

Banking by video call also continues to score. For advice on mortgages, investments or insurance, a quarter more video calls were noted compared to the second half of 2022.

Peter Adams, CEO of ING Belgium:

“Banking made simple remains the starting point of our strategy. Today, we see that our efforts over the past three years have given a strong boost to the bank’s annual result. Now that the foundations have been strengthened, we are ready for a new chapter: full commitment to growth as a strong partner that creates an impact both for the Belgian economy and for all segments of Belgian society.”

%2007-03-2022-1.jpg)

%2B2.jpg)

%2B1.jpg)