Papering over the cracks

2017 provided plenty of upside growth surprises, which may have led to some over-optimism about the prospects for 2018. But the story isn’t helped by growing trade tensions, with China and Europe so far rebuffing US demands to do more to cut the latter’s trade deficit. The coming weeks will be critical for the negotiations, with deadlines of May 22 for China and June 1 for Europe, after which tariffs may well be implemented. Markets will have to hope the pattern of Trump making big demands as an opening gambit before accepting more modest moves repeats itself.

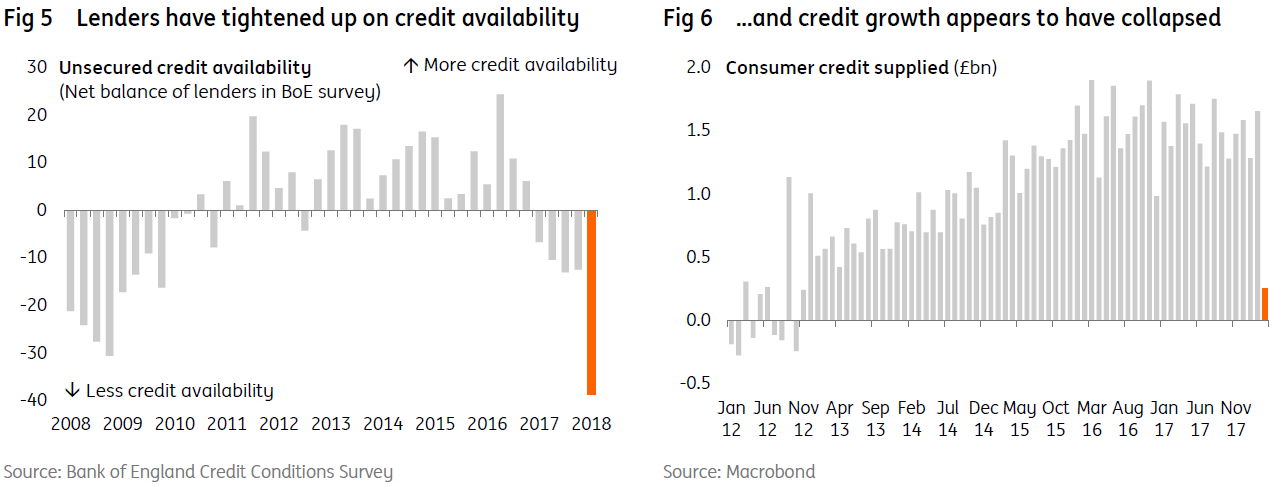

The US economy experienced a slightly softer Q1 than hoped, but despite the political noise, the story remains positive. Growth is supported by tax cuts, a robust jobs market and growing evidence of rising pay. While the dollar has strengthened recently, it remains competitive, which will help exports in an environment of healthy global demand. Nonetheless, there are concerns about the fiscal deficit and rising inflation, which we believe will push longer-dated US Treasury yields higher.

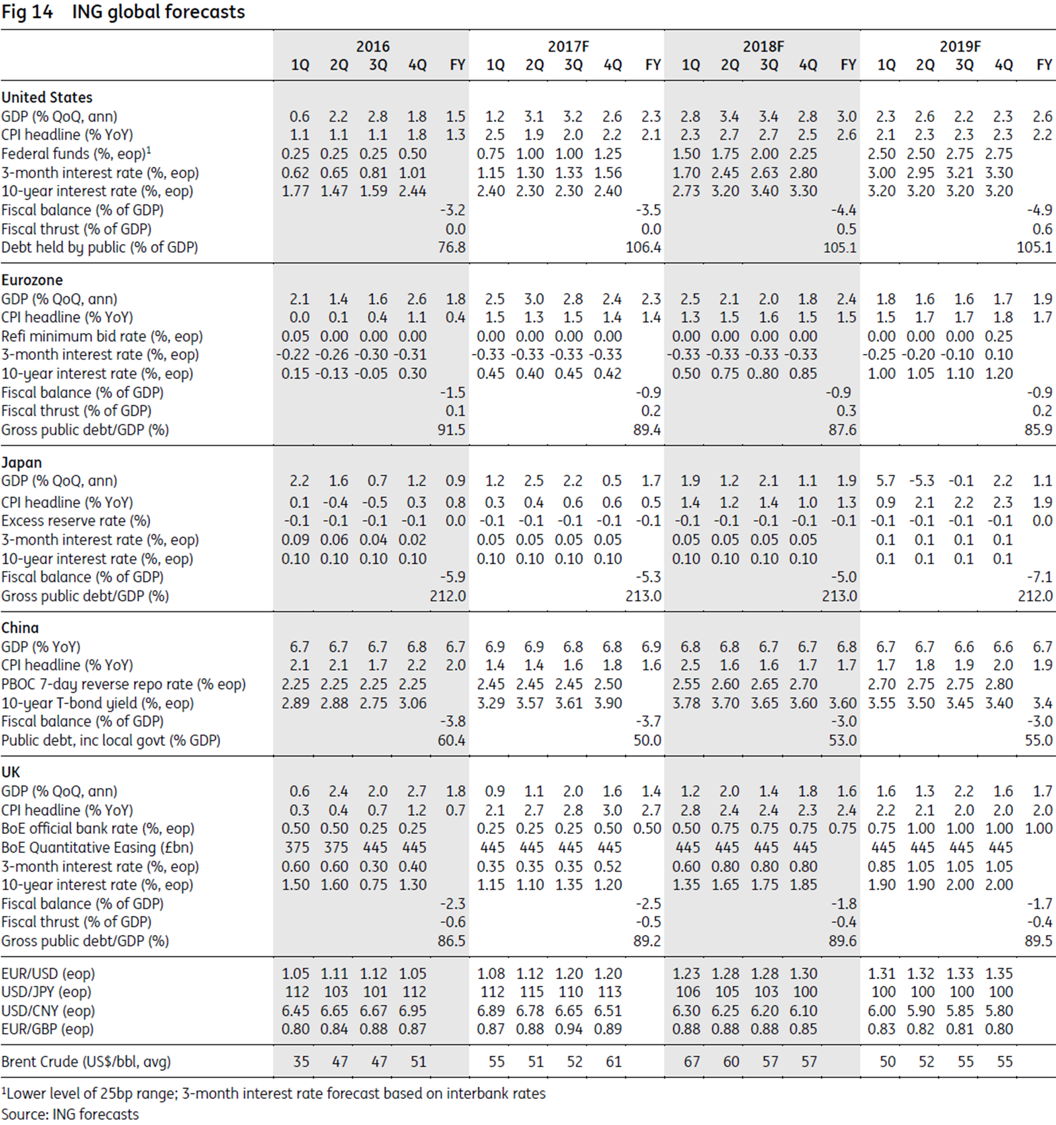

Trade tensions may intensify in the coming months if Europe and China fail to respond to demands to help cut the US trade deficit. This bold strategy is lifting Trump’s approval rating but is doing little to benefit the Republicans ahead of the November mid-term elections. Defeat in the House and/or the Senate would severely curtail Trump’s legislative ambitions for the second half of his Presidency.

The slowdown in the Eurozone has been more marked than in the US, but the big difference is inflation. Rather than pushing higher, inflation in Europe has actually fallen, which is leading markets to re-appraise the outlook for monetary policy. Domestic politics is also proving to be more challenging than expected while Italy could be forced into new elections. In this environment, we have pushed back our call for the first European Central Bank (ECB) rate hike to September 2019.

Following a dreadful first quarter for the UK economy, the Bank of England has put its tightening plans on ice. Cracks emerging in consumer-facing sectors need to be watched closely. But assuming things don’t deteriorate any further, we think an August rate rise remains on the cards as wage growth continues to show renewed signs of life.

The possible collapse of trade talks would increase uncertainty surrounding production in China. We, therefore, expect a slower appreciation path of the yuan. But we keep our GDP growth forecasts unchanged as we expect investment in sectors related to “Made in China 2025” to offset any potential loss from net exports, and related production and services activities.

In Japan, growth is set to pick up after a soft start to the year. However, since inflation is unlikely to trouble the Bank of Japan (BOJ)’s 2% target, a move to tighten monetary policy may have to wait. Indeed, with PM Abe under a political cloud, the risk is that the fiscal stimulus to the economy will fade, forcing the BOJ to ease again.

The dollar has dramatically re-connected with interest rate spreads over the last month. While we cannot rule out a temporary EUR/USD dip to the 1.15/17 area this summer, maintaining those levels will be difficult on a multi-quarter basis.

US: Stormy relations

As with most major economies, the first quarter of 2018 didn’t pan out quite as well as hoped. Bad weather, an aggressive protectionist lurch and financial market volatility all played a part, but it looks as though a stronger story is emerging for 2Q18. Nonetheless, geopolitical and trade tensions persist, as underlined by President Trump pulling out of the Iran nuclear deal. These steps seem to be bolstering Trump’s approval ratings despite ongoing media scrutiny of his personal life. The Republican Party is not benefiting though. Polls suggest they will lose control of Congress, which would severely curtail Trump’s legislative ambitions in the second half of his Presidential term.

Output growth of 2.3% annualised in 1Q was respectable but softer than the three quarters that preceded it. Most of the damage was done in January and February. High-frequency data suggests that momentum has since picked up with consumer confidence, the jobs market and spending looking better in April. Tax cuts and rising incomes will continue to support domestic demand while net exports are also looking better, thanks in no small part to the lagged effects of dollar weakness.

Meanwhile, inflation pressures continue to build. The core personal consumer expenditure deflator is the only inflation reading that is below the Fed’s 2% target, and even that will soon be above. Price pressures were relatively muted in the April-August 2017 period so just a couple of 0.2% month on month readings will be enough to push annual inflation rates higher over the summer of 2018. We may see headline consumer price inflation up at 3% (or higher if oil prices continue to climb) and core at 2.5%. This would stoke fears of overheating in the US economy.

Average earnings growth is still relatively subdued, but the broader employment cost index is picking up more markedly while other surveys suggest pay is accelerating – the National Federation of Independent Business reported the net proportion of companies awarding pay rises has only been higher on one occasion in its 34-year history – May 2000.

Given this backdrop, we continue to look for three more Federal Reserve rate hikes this year with at least two more in 2019. We also see upward pressure on the longer end of the yield curve as markets increasingly take on board the risk of upside inflation surprises. As such, the yield curve should continue to flatten but remain upward sloping.

Furthermore, the fiscal deficit is set to hit 5% of GDP in the next year, and with the Fed running down its balance sheet, supply pressures could see yields rise. Then there is the threat that if trade tensions escalate one possible response from China could be to become unpredictable at Treasury auctions. This could run the risk of the odd failed auction, creating more volatility and occasional yield spikes, which would hurt investor sentiment.

Regarding trade tensions, the US has demanded that China cuts its $340bn trade surplus with America by nearly two-thirds over the coming two years and not launch any counter-measures. It is hard to see China complying, but we are hopeful we might see a similar pattern to the NAFTA negotiations. i.e. The US going in making very aggressive early demands before softening its stance over subsequent months. In fact, a new NAFTA agreement may not be far away. In any case, such aggressive cuts to the Chinese surplus will be difficult to achieve given the massive tax cuts that US consumers are likely to put to use buying foreign-made consumer goods. China will effectively have to block exports, which seems improbable.

While these tensions pose clear risks for trade and economic activity, this aggressive posturing does appear to have given Trump’s approval rating a boost – it currently stands at a 12-month high. Although we have to point out that it is still the lowest rating for any post-war President. His 42% rating stacks up poorly with the 57% average for the previous nine incumbents at the same stage in their Presidency and it isn’t translating into votes for Republican politicians.

Recent opinion polls suggest that Democrats currently hold a seven-point lead heading into the mid-terms. March’s loss of Pennsylvania’s 18th District is a clear warning for the Republicans, who won it by nearly 20 points in 2016. Given the state’s long association with coal and steel, this suggests that while some people may respond positively to aggressive trade rhetoric, it is not going to be enough to win over a sceptical electorate.

The whole of the House of Representatives is up for grabs in November, along with a third of the Senate, 36 governorships and numerous local seats and official positions. If the Democrats do well and take one or both chambers (the House is the most likely given the Democrats are defending the majority of the Senate seats up for election), this will allow them to block both Trump’s legislative agenda and any nominations to the judiciary or other posts. It would also give the Democrats much greater power to launch investigations into Trump and his administration, which would no doubt ratchet up talk of potential impeachment. The process for impeachment starts in the House, but it would still require two-thirds support from the Senate to pass, which doesn’t look very likely at this stage.

Big Republican losses would require much greater bipartisanship to get legislation passed, which would hurt the chances of any further tax changes and could potentially limit President Trump’s infrastructure spending ambitions. It would also mean no repeal of Obamacare.

Conversely, if the Republicans manage to spring a surprise and maintain control of all three legislative arms, it will likely embolden conservatives to push on ripping up President Obama’s legacy legislation with Trump taking the vote as an endorsement of his geopolitical and trade stance. Such an outcome is likely to trigger concern intensifying tensions with China.

James Knightley, London +44 20 7767 6614

Eurozone: Reality check

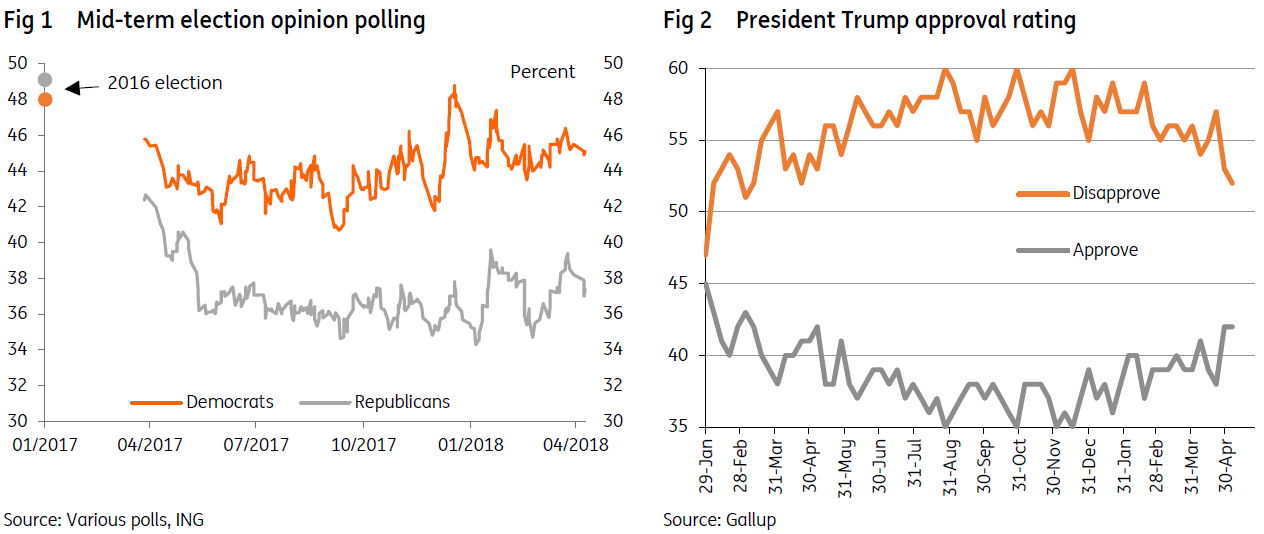

In 2017, the Eurozone surprised the markets to the point that expectations for 2018 were scaled up continually. However, news since the beginning of the year has brought back some realism. As we have already signalled, peak growth for the Eurozone now seems behind, though the first quarter could have been slightly stronger if there hadn’t been a number of one-off effects. At the same time, core inflation has unexpectedly fallen back to only 0.7%, which increases the probability that monetary policy will stay loose for longer than markets had anticipated.

First quarter GDP growth came in at 0.4% quarter-on-quarter, a clear slowdown from the 0.7% pace seen in the last quarter of 2017. There have certainly been one-off effects dragging down growth. An unusual cold spell in March might have affected construction activity negatively in the first quarter, while the flu epidemic probably also hurt activity. Apart from that, strikes in Germany and the timing of the Easter holiday had a dampening effect.

High oil prices which turned out to be more persistent than we anticipated, probably weighed on consumption. While some of these elements are bound to disappear, it’s not as if the first indicators for the second quarter point towards an acceleration of the growth pace. Some of the more forward-looking components of the confidence indicators, like new orders, have softened signalling that a somewhat slower cruising speed seems a more realistic assessment or that it could take a bit longer before a rebound emerges. Taking all of this into account, we’ve decided to cut our growth forecast for 2018 to 2.2% from 2.4% and to 1.8% from 1.9% for 2019.

On the political front, the news is not really encouraging either. The French president continues to struggle with protests at home against his reform plans, while his ambitious agenda for Eurozone reform doesn’t resonate much with the new German government. In Italy, we are now at the point that new elections have (almost) become inevitable, only prolonging the stalemate. While Greece has been over-performing in terms of budget consolidation, there has been no decision on further debt relief, though we still see it likely before the program ends in August. According to recent reports, Greece could still fall short of implementing all required measures before exiting the bailout.

From an economic point of view, the real shocker was the inflation report for April, with core inflation falling back to 0.7%. To be sure, some decline was expected because of the early Easter holidays, which drove up prices in March. But if we take the average of March and April to correct for this distortion, we still end up with core inflation below 1.0%.

Even if higher oil prices and the somewhat weaker euro could lead to higher headline inflation forecasts for 2018 and 2019 in the next ECB staff projections in June, it remains clear that the ECB’s Governing Council expectation that inflation will sustainably converge to target in the medium run is ambitious. Actually, the minutes of the most recent meetings of the Governing Council show that the Council members themselves see plenty of reasons why inflation might undershoot.

In this regard, we believe that even though the net purchase of bonds might still end in December, the probability of a rate hike in June 2019 is getting smaller. We now think that a first rate hike will have to wait until September 2019. At the same time, the ECB is likely to put more emphasis on the reinvestment program of maturing bonds. Given the fact that the Bank has been closely monitoring the unwinding of the QE program in the US, it seems likely that the ECB will keep its reinvestment program in place for another three years after the end of net purchases.

Interestingly, the ECB staff has tried to quantify the impact of its unconventional policy on the 10yr bond yield. For 2018, this drags down long yields by about 110bp. For 2021, the ECB still sees a downward impact of about 75bp, meaning that the upward pressure of the unwinding of QE will only be very gradual.

Peter Vanden Houte, Brussels +32 2 547 8009

UK: Carney goes cautious

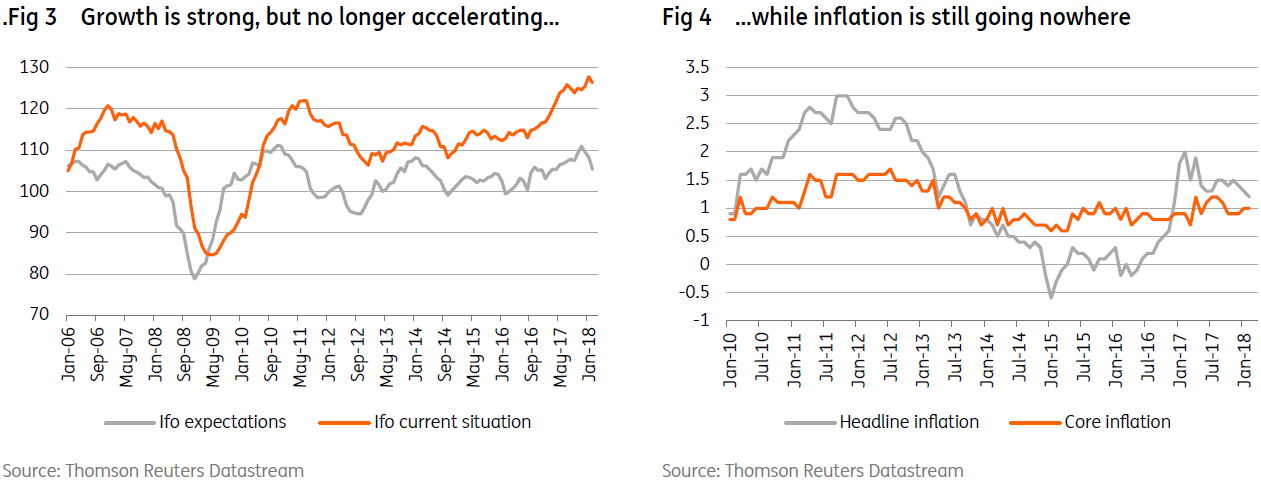

It’s fair to say the build-up to the May Bank of England meeting has been a rollercoaster. Having more-or-less fully priced in a May rate hike, markets have received quite a shock following cautious comments from the Bank of England (BoE) Governor Mark Carney a few weeks ago. This was all the more surprising given other BoE rhetoric so far this year, which had appeared to guide markets to a more rapid path of tightening.

So why the sudden change of heart? Well, over the past few weeks it’s become increasingly clear that the economy had a very tough time in the first quarter. Growth came in at just 0.1% QoQ, the weakest result since 2012, and the Bank will be aware that hiking in such an environment would be a tough sell.

Admittedly, some of the causes of the slowdown were temporary – multiple bouts of snow saw construction activity make an unusually large negative contribution to first quarter GDP. The bad weather will have had repercussions elsewhere in the economy too. But we don’t think this tells the full story.

Serious cracks are appearing in consumer-facing sectors. The perfect storm of weaker demand, higher business rates and rising minimum wage costs resulted in one of the worst quarters for retail since the financial crisis. A rate hike now might prove to be one headwind too many for retailers, many of whom have become highly leveraged in the post-crisis years.

Unfortunately, we don’t think things are about to get much better immediately. Real incomes remain pressured by higher food and fuel costs. Alarmingly, consumer credit growth also appears to have collapsed in recent months, with banks reportedly scaling back loan availability significantly. This may prove to be a blip, but we suspect the Bank wants to buy more time until the underlying drivers of this rapid downfall become clearer.

However, we don’t expect the Bank’s pause this month to turn into a permanent hiatus. Away from the activity story, the major drivers underpinning the Bank's recent tightening bias have remained largely on track. The prospects for global growth still look relatively bright, despite the recent moderation in Eurozone activity. Similarly, wage growth has continued to outperform over the last few months, giving policymakers greater confidence that skill shortages in the jobs market are boosting pay. Bank agents have indicated that this could be the best year for pay settlements since the crisis.

Nonetheless, policymakers will also be acutely aware that their window to hike rates could close soon. If the build-up to the December and March EU leader's meetings is any guide, the months leading up to the October summit could see negotiations get increasingly noisy. Talks are already heating up, as the cracks with the UK government widen over the future customs relationship with the EU.

At the same time, we expect to see core inflation fall back to target over the summer, given that prices have now virtually adjusted to the new value of the pound. This has seen inflation fall noticeably faster than the Bank of England forecasted in February.

These two factors could complicate efforts to hike rates later into the year, and we think the Bank will be keen to capitalise while they can. Assuming the faltering consumer sector doesn't deteriorate further, we think there's a good chance the Bank will hike again in August.

James Smith, London +44 20 7767 1038

China: Accelerating the plan

We are sceptical about the outcome of trade talks between China and the US over the coming months. According to media reports, the US demands are mostly related to China's national strategy, “Made in China 2025”. Given that China maintains these demands are unreasonable, therefore, it is difficult to see Vice Premier Liu He's forthcoming trip to the US yielding any material results. The most likely outcome for the second round of trade negotiations will be a stalemate.

Exporters that could be affected by the respective US and China trade demands should think hard about their business or at least contingency plans. The increasing uncertainty arising from a stalemate situation will complicate business decisions on future investments.

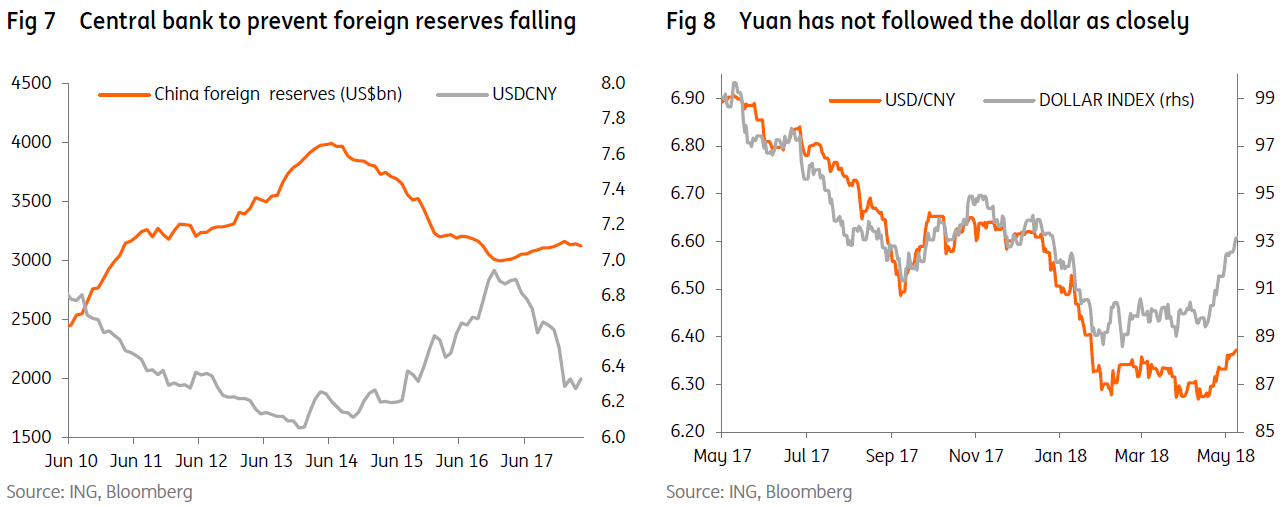

We believe that with the potential negative impact on the economy stemming from a more difficult trade backdrop, this would encourage the central bank to appreciate the yuan at a more moderate pace. This is one of the reasons that we have revised our forecast of USDCNY from 6.10 by the end of 2018 to 6.33.

We still expect the yuan to appreciate in 2018 because depreciation would encourage capital outflows, leading to a rapid depletion of foreign exchange reserves similar to the situation between mid-2014 and late 2016. The central bank will try to avoid repeating history especially when the economy faces additional risks from trade tensions.

Moreover, a few percentage points of yuan depreciation will do little to alleviate the trade pressures that China says the US is placing. Indeed, it would likely make negotiations even more fractious, as the US could claim, China was manipulating the currency to boost exports.

We can see support for such reasoning in the recent path of USDCNY. Even when the dollar index strengthened more than 2.5% in April, the yuan only depreciated 1.2% against the USD. This should result in yuan appreciation against the dollar in 2018.

The US sanctions on a Chinese telecommunication equipment producer has exposed the weakness of China in terms of its self-sustainability in the production of high-quality tech parts as well as the lack of its own smartphone operating system. But the timing of all this is not too bad, given that China’s GDP is growing at a rate of 6.5%. The economy can afford to invest more in this sector to achieve self-sustained high-tech sectors as soon as possible.

We expect that fixed asset investments in high-tech manufacturing and infrastructure in 2018-2020 will grow to near 10% YoY and 20% YoY from the latest 3.8% YoY and 13% YoY, respectively. This is likely to boost GDP growth, which will offset the loss of net exports and related production and logistic services following from the US sanctions and potential tariffs.

This is why we have kept our China GDP growth forecast unchanged at 6.8% for 2018 and 6.7% for 2019.

Iris Pang, Economist, Greater China, Hong Kong +852 2848 8071

Japan: Slow start

It is becoming quite “the thing” to start the year weakly. The US does it almost every year. Europe also seems to have recorded a soft-patch in 2018. Japan too seems to have started the year in a less than convincing fashion. Consensus opinion has Japan growing at only 0.5% quarter on quarter in 1Q18.

It is easy to blame bad weather for economic weakness, only for it to turn out that the economy was genuinely weak all along. But in Japan’s case, we think there is genuine room for optimism.

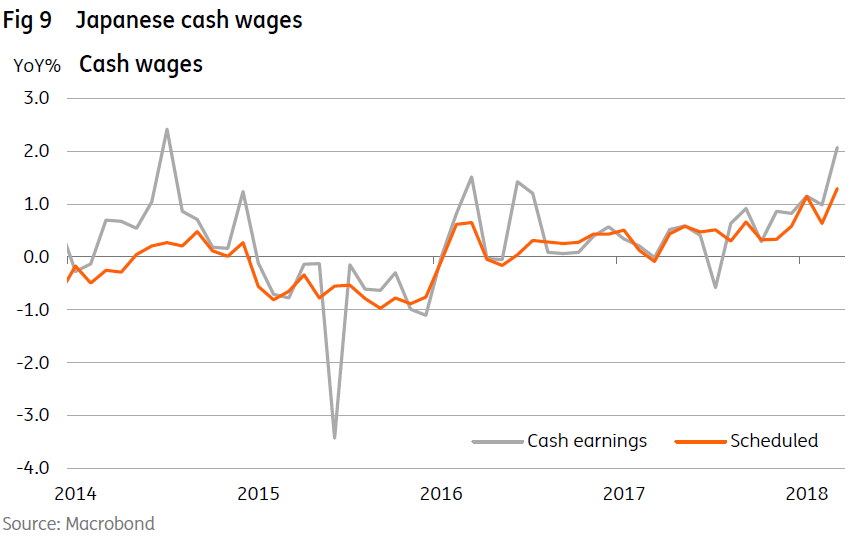

A recurring theme in these monthly notes has been PM Abe’s attempts to get Japanese firms to pay higher wages, especially regular wages (not bonuses) to spur consumer spending. March cash wages rose 2.1%YoY. This might not sound like a lot, but wages haven’t risen this fast since 2014. Real wage earnings in March were also 0.8% higher than a year ago.

Now, these income numbers may look like a single month’s aberration, and indeed, it is far too early to get excited. But the wage figures also tally with one of the other fundamental indicators we have been tracking – namely corporate profitability. This, especially in the manufacturing sector, has been growing strongly for some time, and it now tentatively looks as if some of this gain is being passed on to Japan’s workforce.

If this wage growth begins to show up in stronger consumer spending growth (not yet all that evident), then there really will be a convincing story of a profit-led, earnings supported, consumer spending upturn taking root.

All that would be missing then as far as the Bank of Japan (BoJ) is concerned would be some inflation. Unfortunately, we don’t believe that this is likely to ensue to the degree needed to reach the BoJ’s 2.0% target. That doesn’t mean the economy remains too weak, rather than the 2% target was always unrealistic and unachievable.

As for the BoJ, we continue to believe that they are ready and willing to consider ratcheting down their asset purchase program. But we think that they would prefer to do so under the cover of some tapering by the ECB. The recent softness of Eurozone data suggests that this is not going to happen as early as we previously thought, though this is more of a delay than a change of forecast.

But what might alter our outlook for Japan and the BoJ is the political backdrop. PM Abe’s hold on the top political job in Japan has been heavily challenged by cronyism scandals around preferential treatment for new schools. Were Abe to be forced to step down, the strongest of the three prongs of Abenomics would likely fade, and that would likely need the BoJ to pick up the slack – with the JPY a likely victim of such additional monetary policy easing.

Rob Carnell, Singapore +65 6232 6020

FX: Re-connecting with rates

Whether it was the two-year EUR:USD swap spread moving through the psychological 300bp level or a brief respite in Trump’s twitter account, the last month has seen the dollar dramatically re-connect with interest rate spreads. This has caused substantial problems for investors positioned for a benign dollar trend and EM growth stories. While we have been forced to upgrade our dollar profile for this summer, we still think the dollar will be weaker by year-end and through-out 2019.

Interest rate spreads had little bearing on the dollar trend between last September and this March. But that all changed from mid-April onwards which has now seen the trade-weighted dollar reclaim all of this year’s losses. We believe the severity of the move largely owed to positioning – our long-held dollar bearish had very much become main-stream this year – and probably higher oil prices driving US rates higher.

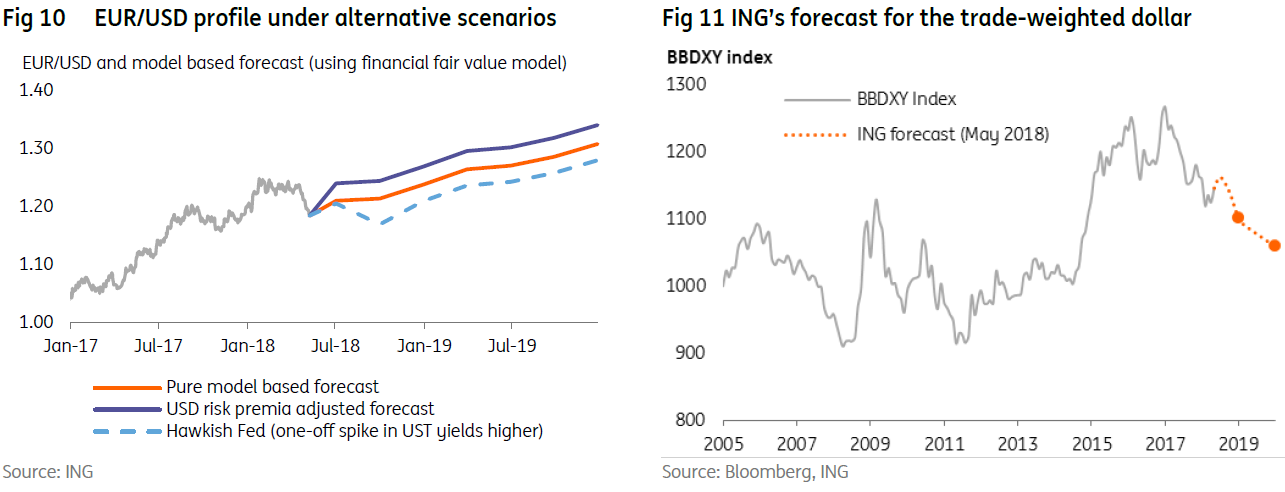

If for a minute we assume that rate spreads – and only rate spreads – drive EUR/USD over coming quarters, what will the EUR/USD profile look like? Using ING’s baseline views for rates, which see US two year yields pushing into the 2.75/80% area this summer, our financial fair value model would see EUR/USD trade near 1.17 this summer before pushing to 1.30 into 2019. A more hawkish interpretation of US rates, with two year-yields at 3.00% this summer, could see EUR/USD at 1.15.

But the above assumes that: i) the economic divergence between the US and the Eurozone continues, ii) that there is no protectionist or fiscal risk premia in the dollar and iii) investors abandon the ECB normalisation story which so helped the EUR in 2H18.

Instead, we see: i) US and Eurozone divergence at its peak right now and expect the Eurozone to recover from the strike/weather/flu-related slow-down in 1Q18, ii) protectionist fears may re-appear in late May when Washington decides which tariffs on China won’t be watered down and iii) expect the ECB story to come back into focus into July and particularly by year-end. We, therefore, see EUR/USD downside limited to the 1.15/17 area this summer and retain targets above 1.30 in 2019.

On-going dollar strength would cause more problems in the EM space. Argentina and Turkey normally top the list of those most exposed to a sudden stop in portfolio flows. And elections this year in Turkey, Mexico and Brazil will keep investors on their toes. But as long as EM growth rates – and Rest of World growth rates in general – hold up, economic convergence stories should drive the trade-weighted dollar weaker into 2019.

Chris Turner, London +44 20 7767 1610

Rates: EM eyes the dollar

Many moving parts make for tough interpretation, but one theme runs through the middle, and that has been the path of the dollar. And moreover, the speed at which it flipped from a gradual weakening trend that had an inevitability about it, to showing a wicked strengthening streak. It is one that has in a flash exposed vulnerabilities stretching from the likes of Argentina to Turkey to Indonesia. Emerging markets (EM) have been spooked.

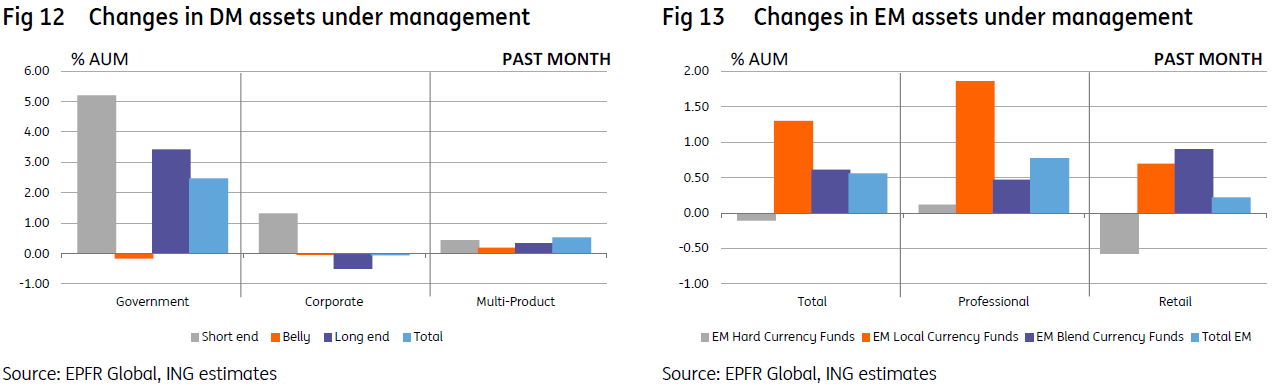

But at the same time, there is no contagion in play. Some correlation yes, but there is enough collective calm to ensure that sensible relative valuation is still ‘a thing’. Also, there has been no mass exodus from EM. Inflows to EM may have slowed to a trickle but this is no tantrum, at least not yet. The next leg for both the dollar FX and market rates will be crucial though, and we of course have views on both.

One of the things that calmed emerging markets in previous months was that the uplift in the Fed funds and market rates was coinciding with quite a benign dollar. When the dollar turned on a sixpence and rallied that changed, and EM was dealing with a classic double whammy. Higher rates make re-funding more expensive and a firmer dollar then super-exposes the more leveraged (typically high yielding) economies.

We also believe there is a feedback loop here to core rates too, as a firmer dollar acts as a stand-alone monetary tightening, which facilitates less need for rates to head higher. In consequence, one of the reasons the US 10yr yield has not managed to cleanly break free of 3% to the upside is down to dollar strength. Which is why we think that the sustained break above 3% will happen as the dollar finally comes off the boil.

We identify positioning as still pointing towards upward pressure for market rates. We continue to see evidence from flows data of investors liquidating the belly of the yield curve and moving in the front end, to leave the marketplace both short duration and barbelled. A mild build in exposure to long end funds has amplified this (Figure 1), but it still leaves the path of least resistance on a test for higher rates.

The curve structure is also pointing in the same direction, as the 5yr is trading cheap to the curve (2/5/10yr fly). A cheap 5yr is typical of a marketplace that believes there are a run of rate hikes ahead, and usually this is consistent with market rates rising and the term structure flattening. No imminent fear for inversion though, as long end rates are rising too. The 10/30yr could well invert, but the benchmark 2/10yr won’t in 2018.

This process of a gradual probe higher for rates likely continues. An abrupt further dollar appreciation leading to a wider EM tantrum would abort this. The central view sees the dollar ultimately reversing course. But the alternative risk case is real and present.

Padhraic Garvey, London +44 20 7767 8057