ING continues to deliver strong growth in 2024, reinforcing its commitment to customers and society

The bank confirms its growth trajectory, with a pre-tax profit of €1.2 billion and a net result of €889 million

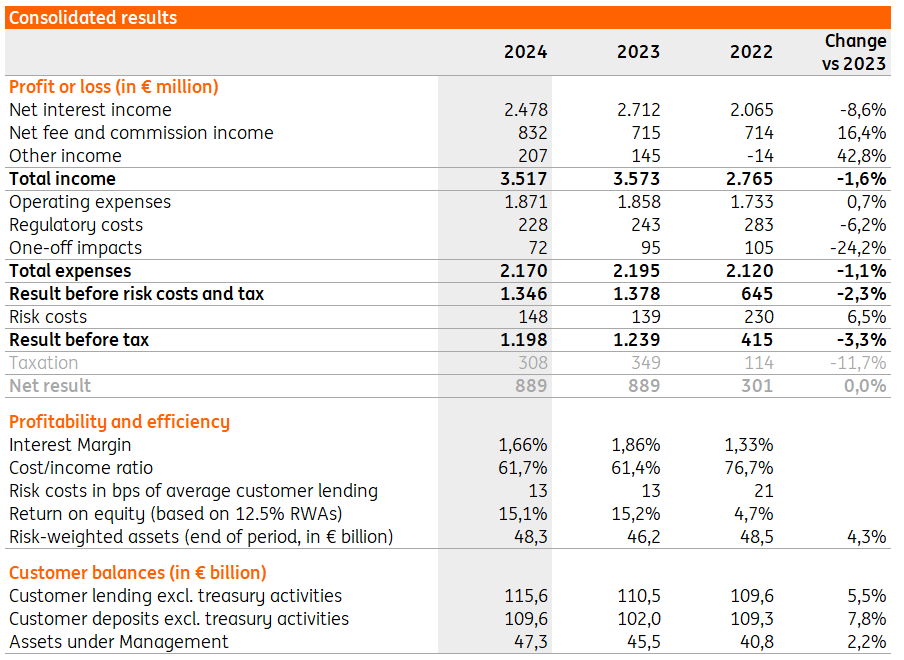

ING Belgium posted a strong result in 2024, with a pre-tax profit of €1.2 billion, a net result of €889 million, at the same level as 2023. Total income reached €3.5 billion, close to the bank’s record-high income for 2023. In the falling interest rate environment, deposits increased by €7.6 billion year-on-year, reaching €109.6 billion. A key force behind this result was the fixed term account promotion in September. ING’s loan portfolio grew by more than €5 billion to €115.6 billion, confirming the bank’s commitment to provide financing to society at large.

Peter Adams, CEO of ING Belgium: “In 2024, ING Belgium reaped the rewards of its continuous efforts to improve the quality of its services. We were able to focus on the growth of its balances, whether deposits or loans. We are pleased that our ‘Together for Progress’ strategy benefits our results, our customers and society at large."

Good commercial momentum is witnessed by growth in all customer balances

By the end of 2024, customers had entrusted ING with €109.6 billion in deposits, representing a year-on-year increase of €7.6 billion. The bank’s competitive term deposit campaign in the autumn, which resulted in €5.5 billion’s worth of new deposits, largely contributed to this growth in volume. It also generated an increase in new customers and the opening of more than 80,000 new current accounts. The remaining deposit growth mostly came from business banking customers, the institutional subsegment in particular.

Assets under Management rose by €1.8 billion to €47.3 billion in 2024. ING expanded its investment offer with DBI-RDT mutual funds targeting entrepreneurs, with private equity & private debt offerings. In addition, an increasing number of entrepreneurs, who are already customers, were convinced by ING’s sharpened private banking offer.

The increase in ING’s loan portfolio by more than €5 billion to €115.6 billion confirmed the banks’ commitment to provide financing to society at large. Most of this increase came from business and wholesale banking customers.

Customer balances growth supports the revenue base while interest rates declined

With a total income of €3.5 billion in 2024, this number is close to the bank’s record-high income registered in 2023. As the ECB started to decline policy rates as from the second half of 2024, the bank’s net interest income declined by 8% compared to 2023, and ended at €2.5 billion.

Thanks to the strong volume growth mentioned earlier, ING grew its fee and commission income by more than 16%. The increased activity in investment products, higher sales in insurance products in both private and business segments and strong fee growth in Wholesale Banking’s financial markets division, all contributed to this good result.

Business growth does not come at the expense of increased costs or loan loss provisions

Thanks to the bank’s ongoing pursuit of efficiency gains, business growth in 2024 was realised with an operating expense base that was only marginally higher (<1%) than in 2023. Cost discipline kept the banks’ expense growth well below the inflation level of 2024.

In 2024, ING added €148 million to its stock of loan loss provisions. This amount is comparable to what was recorded in 2023 and represents 0.13% of the bank’s total loan book, which remains well below the long-term average.

Hans De Munck, CFO of ING Belgium: “Over the past years we have unquestionably built a more efficient bank, but what our strong financial results for 2024 really show is that we have also built a bank with strong commercial muscle. The growth across all segments, whether Private Individuals, Business or Wholesale Banking, is the ultimate proof of that. This growth, together with continued cost discipline, allows us to match the record results of 2023.”

In-app sales up by 87%

ING continued to invest in its digital channels, which translated into strong commercial results. In Retail Banking, 55 daily banking journeys were added to the ING Banking app. In-app sales went up by 87% compared to 2023. More than 90% of the promotional term accounts were opened digitally, thus proving a frictionless user experience. The number of customers opening an ING Easy Invest account, the digital solution for customers wishing to follow ING’s investment strategy, tripled compared to 2023. To improve the process for new customers, the bank revamped its mobile onboarding journey. In 5 simple steps, a customer can open an account and then get a guided tour of the app, key products and features.

Making banking simple remains ING’s motto, giving customers the freedom to choose how they interact with the bank. In 2024, ING’s contact centre saw an increase of 35% in chat volumes compared to last year. Video banking also gained traction, with a 52% rise in video calls for mortgages and a 22% increase for investments. For customers preferring in-person meetings, the bank’s 150 branches are open in the mornings without the need to make an appointment. The bank’s digital capabilities have reached a significant level of maturity, improving customer experience and reducing manual handling in branches and contact centres by more than 50%.

Growth in loan portfolio confirms commitment to finance society at large

The bank smoothed the way for business customers to easily apply online for loans of up to €100,000. As a result, in 2024, 75% of loans awarded for an amount of €100,000 or less were in the company's account the following day. This is an increase of 50% compared to 2023.

ING more than tripled its sustainable lending volumes and allocated 90% of the EIB-facility to SMEs and mid-caps, but also broadened its value proposition with sustainable finance products.

In the Wholesale Banking segment, alongside growth in loans and new mandates, ING confirmed its position as a sustainable finance leader in Belgium, Luxembourg and the Nordics, as the bank took on a sustainability lead role in more than 64% of transactions.

The bank also saw mortgages increase by 10% in 2024. To support families, the bank introduced a mortgage rate discount for customers who renovate their home and improve its energy score. ING now offers mortgages with a 30-year term, giving customers the opportunity to increase their budget and maximise their investment in sustainable renovations.

Peter Adams, CEO of ING Belgium: “In 2024, ING Belgium was fully committed to growth, acting as a strong partner to create impact in the Belgian economy and to tackle the challenges our society faces. We will continue to do so in 2025, our objective is to be even more outward-looking. We want to bring the strength of our balance sheet to Belgian entrepreneurs so they can make investments to secure their competitiveness. We want to further strengthen our offer in investments and focus on what our customers need”.

About ING

ING Belgium is a universal bank that offers financial services to private customers, companies, and institutional clients. ING Belgium SA is a subsidiary of ING Group SA, via ING Bank SA (www.ing.com).

ING is a global financial institution with a strong European base, offering banking services through its operating company ING Bank. The purpose of ING Bank is: empowering people to stay a step ahead in life and in business. ING Bank’s more than 60,000 employees offer retail and wholesale banking services to customers in over 100 countries.

ING Group shares are listed on the exchanges of Amsterdam (INGA NA, INGA.AS), Brussels and on the New York Stock Exchange (ADRs: ING US, ING.N).

ING aims to put sustainability at the heart of what we do. Our policies and actions are assessed by independent research and ratings providers, which give updates on them annually. ING’s ESG rating by MSCI was reconfirmed by MSCI as ‘AA’ in August 2024 for the fifth year. As of December 2023, in Sustainalytics’ view, ING’s management of ESG material risk is ‘Strong’. Our current ESG Risk Rating, is 17.2 (Low Risk). ING Group shares are also included in major sustainability and ESG index products of leading providers. Here are some examples: Euronext, STOXX, Morningstar and FTSE Russell.

Sylvain Jonckheere

The results presented on this page include ING Belgium and ING Luxembourg. Please find the results of ING Group here: https://www.ing.com/Investors/Financial-performance/Quarterly-results.htm

%2007-03-2022-1.jpg)

%2007-03-2022-1%20crop.jpg)

%2007-03-2022-1.jpg)

.jpg)