ING BELUX HALF–YEAR RESULTS 2018

During the first half of 2018, ING achieved an impressive business performance, with customer lending and deposit volumes both exceeding the € 100 billion mark for the first time in its history.

Pressure on interest margins, however, continued to negatively influence results before tax.

At the same time, ING in Belgium implemented many of the steps it had announced within the framework of the transformation towards the new business model.

ING now has its organisational track laid out, is ready for the future and is focusing on maturing the model. The next big steps are rationalising our product assortment and uniting the IT platforms in Belgium and the Netherlands.

Financial Results

-

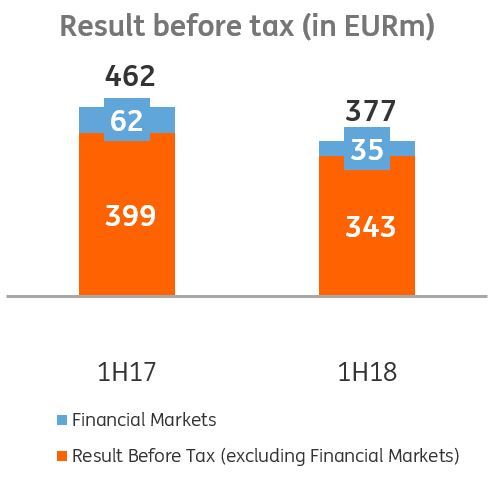

€ 377 million underlying result before tax

-

Both lending and deposits have exceeded the € 100 billion mark in the course of 2018

- Lending[1] at € 101.7 billion; an increase of 7.4% or € 7.0 billion compared to first half of 2017

- Deposits at € 102.0 billion; an increase of 4.1% or € 4.0 billion compared to first half of 2017

-

Continued margin pressure on savings and current accounts as a result of the low interest rate environment and lower demand for retail investment products

-

Balance Sheet position remains strong, with solid liquidity and capital ratios

Business Performance

-

Net increase of 56,000 ING Lion Accounts or +8%

-

Net increase of 414,000 active clients or +16.7%

-

Net increase of 110,000 primary customers or +8.8%

-

Net increase of 92,000 new active mobile users or +12%

New Business Model

-

Successful integration of Record Bank

-

New retail organisation rolled out

-

Customer Loyalty Teams launched

Financial Results

Excluding Financial Markets[2] compared to the first half of 2017 result before tax decreased by 14% to € 343 million. The decrease was mainly a result of the continued pressure from the low interest rate environment, lower demand for retail investment products and increased investments for the delivery of the new business model. Those impacts were only partly offset by lower number of internal employees and a positive impact of lower legal provision in Luxembourg.

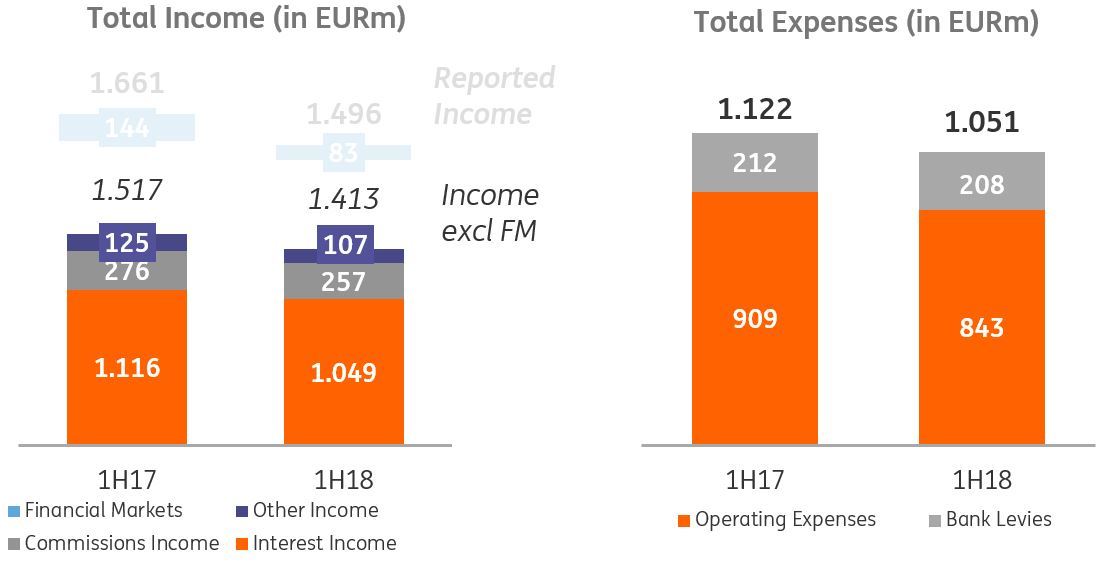

Compared to the first half of 2017, Income excluding Financial Markets decreased by € 104 million (-6.9%) from € 1,517 million to € 1,413 million driven by lower margins on savings and current accounts as a result of the prolonged low rates environment, lower demand for retail investment products by our customers and impact of IFRS 9 implementation. Impact of higher lending volumes was offset by pressure on commercial margins.

The operating expenses have decreased by € 66 million (-7%) compared to first half of 2017 mainly as a result of lower number of internal employees and a positive impact of lower legal provision in Luxembourg, partly offset by the additional investments for the delivery of the new business model.

Both lending and deposits have exceeded € 100 billion in the course of 2018. Lending portfolio[3] has increased by € 7.0 billion (+7.4%) up to € 101.7 billion driven by all segments reaffirming our centricity towards all our customers. The lending growth was funded by € 4.0 billion or 4.1% increase in deposits from € 98.0 billion in the second half of 2017 to € 102.0 billion currently, maintaining ING’s balanced model and strong liquidity position.

Benign economic environment resulted in risk costs[4] of € 67 million in the first half of 2018 which were well within our risk appetite and in line with the level we have observed in 2017.

Business Performance

In 2017, ING laid the foundations for the transformation to the new business model. Following on from this, 2018 marked a new beginning for the bank. In the first half of 2018, the initiatives that had been announced with a view to making ING future-proof were rolled out. In this context, ING served its customers well, as evidenced by the excellent business results achieved.

-

The success of the free ‘ING Lion Account’ continued, with 56,000 (+8%) new accounts opened this year, in part thanks to the successful ‘Red’ (the Red Devils’ mascot) acquisition campaign.

-

The total number of active clients went up by nearly 414,000 to about 2,897,000 (+16.7%) for the most part thanks to the inflow of Record Bank customers and the successful acquisition campaign, of which ‘Red’ was one of the main features.

-

Furthermore, there was an increase in the number of primary customers - customers who have a current account with ING that has regular flows coming in, for instance salary payments, and at least one additional product - of just over 110,000 (+8.8%) to a bit more than 1,359,000 for the most part thanks to the inflow of Record Bank customers.

-

Digital adoption, a key pillar for the success of the strategy, keeps accelerating. In the first semester of 2018 ING registered a net increase of close to 92,000 new active mobile users (+12%).

Smart, easy and personal

Creating a differentiating banking experience for customers is what ING does. Applying this philosophy, it systematically improved its customer service offer during the first half of the year:

-

Living up to its role as a pioneer, ING was the first major bank in Belgium to provide same-day processing for all payments.

-

The continuous enhancement of digital channels has led to noteworthy improvements in the ING Smart Banking app. Private individuals can now:

-

replace an unreadable or broken credit card

-

modify the limits for a debit card

-

manage their investments

-

buy and sell securities or funds

-

view and cancel pending orders

-

-

ING is also making the lives of its business clients a lot easier by digitising complex services. For example, it now has 28 services relating to existing credit agreements available online, such as changing a credit limit, the term of a contract or the account number linked to a loan.

-

Funding Compass is a platform for guiding customers and business prospects in their choice of funding. The Funding Compass platform offers up to 40 funding solutions based on 8 simple questions. The alternatives offered include not only traditional bank loans, but also crowdfunding, equity and government funding solutions. The aim is to make it the reference "Go To Platform" for business customers looking for funding.

Innovation can come from within the organisation, but ING also strongly believes in open collaboration and supporting ambitious start-ups. For the third year in a row, ING hosted the ING Fintech Village, the dedicated accelerator for start-ups in the field of financial technology. Proofs of concept are tested, and solutions which are instrumental in creating a differentiating customer experience are integrated into our services. Here, the conversion rate to contracts is an impressive 50%. Two of the innovations that ING recently launched in collaboration with our fintechs are:

- Contract.fit is helping customers to compare, choose and switch gas and electricity suppliers.

- Insurance products can be complex, and a lack of transparency often encourages customers to base their decisions on price alone while the coverages and services are not necessarily the same. Minalea is a smart sales assistant that helps branch employees compare insurance products and guide our customers in selecting the insurance products that suit them best.

Remarkable business deals

ING Lease has signed a historic deal with Kristal Solar Park for an amount of more than € 62 million. Kristal Solar Park is a joint venture between LRM (Limburgse Reconversie Maatschappij) and the city of Lommel. It is set up to build a 100 Megawatt Solar Park which will be the largest one in the Benelux (this equals no less than 220 football fields full of solar panels). Next to that, another deal signed with LRM is a sustainable battery project whereby Tesla batteries are used as a primary reserve of energy to help level out differences in production and consumption. The importance of battery-based solutions will only increase, since solar and wind are less predictable than traditional forms of energy production.

ING supported bpost in preparing its first appearance in the debt capital market with the intention of using the proceeds to partly refinance bridge facilities used for its acquisition of Radial. This inaugural

€ 650 million transaction was a massive step for bpost to take, following its IPO a few years ago.

In the Green Bond market, ING successfully assisted the Kingdom of Belgium to issue its first € 4.5 billion Green Linear Bonds (OLO) as a joint book runner, underlining its commitment of the development of Green and Climate Finance. The proceeds of the green bond will primarily be allocated to the sector of clean transportation (85%), and will primarily serve to (re)finance investment expenditures (66%).

New Business Model

ING in Belgium and the Netherlands will bring together their respective strengths to deliver an even better and consistent experience for our combined 11 million customers. The aim is to deliver a universal customer experience that is best-in-class, with one integrated banking platform, a harmonised business model and a shared operating model.

Increased availability

In March 2018, the new Retail organisation was launched and gradually rolled out. With this new approach, personal advice has become more accessible. When customers now come into an ING branch, their first contact person, is the Customer Coach. If they are coming for simple banking services, the Customer Coach will help them find their way to the digital channels or to the Customer Loyalty Teams (CLTs). If they are coming for advice, then the Customer Coach will refer them to the right banker. Today 3,200 bankers are available for customers in 665 branches. The advisors in those branches are available from 8 a.m. to 8 p.m. on weekdays and 8 a.m. to 1 p.m. on Saturdays.

The new Client Services model ensures that customers no longer have to go to their branch for simple banking services. Between 8 a.m. and 10 p.m. on weekdays and between 9 a.m. and 5 p.m. on Saturdays, customers are able to talk to a contact in the Customer Loyalty Teams by phone, mail or chat. So far, around 600 CLT-employees are available for our customers to help them handle simple banking matters from A to Z at a distance.

From the employee point of view, this also entails changes and for example they are much more empowered to work flexibly. The timetable and availability of advisors are no longer linked to the branch opening hours. The most important thing is being available for the customer. With this priority in mind, the advisors decide as a team when and where they will work (customer contacts outside the bank, or work from home).

Successful integration of Record Bank

Part of the harmonised business model involved integrating the banking activities of Record Bank. In 2017, the work took place mostly behind the scenes, in preparation for the integration. The operation was then launched and completed in the first half of 2018.

Over a period of two months, ING was able to migrate 600,000 Record Bank customers successfully. This huge technical achievement was possible thanks to the dedication of ING employees of which 800 worked on the migration and 250 during each migration weekend.

Next to this technical challenge, this operation also included an impressive welcome campaign for Record Bank customers at ING branches. Nearly 300,000 telephone calls were made to welcome customers and all customers were invited to a Branch Welcome Day. Some 340 of these events were held across the country. In addition, face-to-face meetings took place to get to know customers in person, as well as to identify individual needs.

With this move ING is seeking to build a stronger and more future-proof network for its customers, providing a better geographic distribution of branches. At the same time, it is offering former Record Bank customers the possibility to use the digital functionalities and segment-specific expertise typical of ING.

|

A few figures:

|

People update

In 2018, some 2,800 employees within the organisation started in a new role to accommodate the aforementioned business model changes.

The trade unions and ING developed the Job Accelerator for the employees who were not retained after the redeployment procedure at the end of 2017. This provides a series of specific accompanying measures (job fairs, workshops and personalised off-boarding tracks) with a respectful approach to find a job within or outside ING. After the first 6 months of 2018, nearly 60% of employees having gone through the programme, have a clear outlook for new employment, 11% of which within ING.

In addition, leave measures organised through a Collective Labour Agreement (CLA) were put in place to accompany leavers.

-

332 employees left the bank via the early leave measure (55+) in the first half of 2018 (430 since October 2016) and another 509 have requested to benefit from this measure but have not left the organisation yet

- 11 employees have left the bank to start their own business with the support of ING in the first half of 2018 (54 since October 2016) and another 8 have requested to benefit from this measure but have not left the organisation yet

- 94 employees were granted voluntary or recognised leave in the first half of 2018 (410 since October 2016) and another 9 have requested to benefit from this measure but have not left the organisation yet

ING was able to limit the number of dismissals to 130 in the first half of 2018 (213 since October 2016).

The total number of employees who have left the organisation under the CLA measures since October 2016 comes to 1,107. The number of new hires is 529 (797 since October 2016).

Conclusion

It has been an active first six months of 2018, during which employees have shown courage, resilience and focus. No fewer than 2,800 people have had their job content change, while in the meantime continuing to achieve strong business results.

ING now has its organisational track laid out. The bank is focusing on maturing the new business model and with this new constellation can now confidently look towards the future.

[1] Excluding loans to Flemish government due to volatility

[2] In the course of 2017 and 2018 majority of Financial Markets trading activities were moved to London in line with Group strategy to consolidate European Financial Markets trading activities in London. This shift has a structural impact on the result of ING Belgium.

[3] Excluding loans to Flemish government due to volatility

[4] Basis points of Risk Weighted Assets