ING Belux Half Year Results 2017

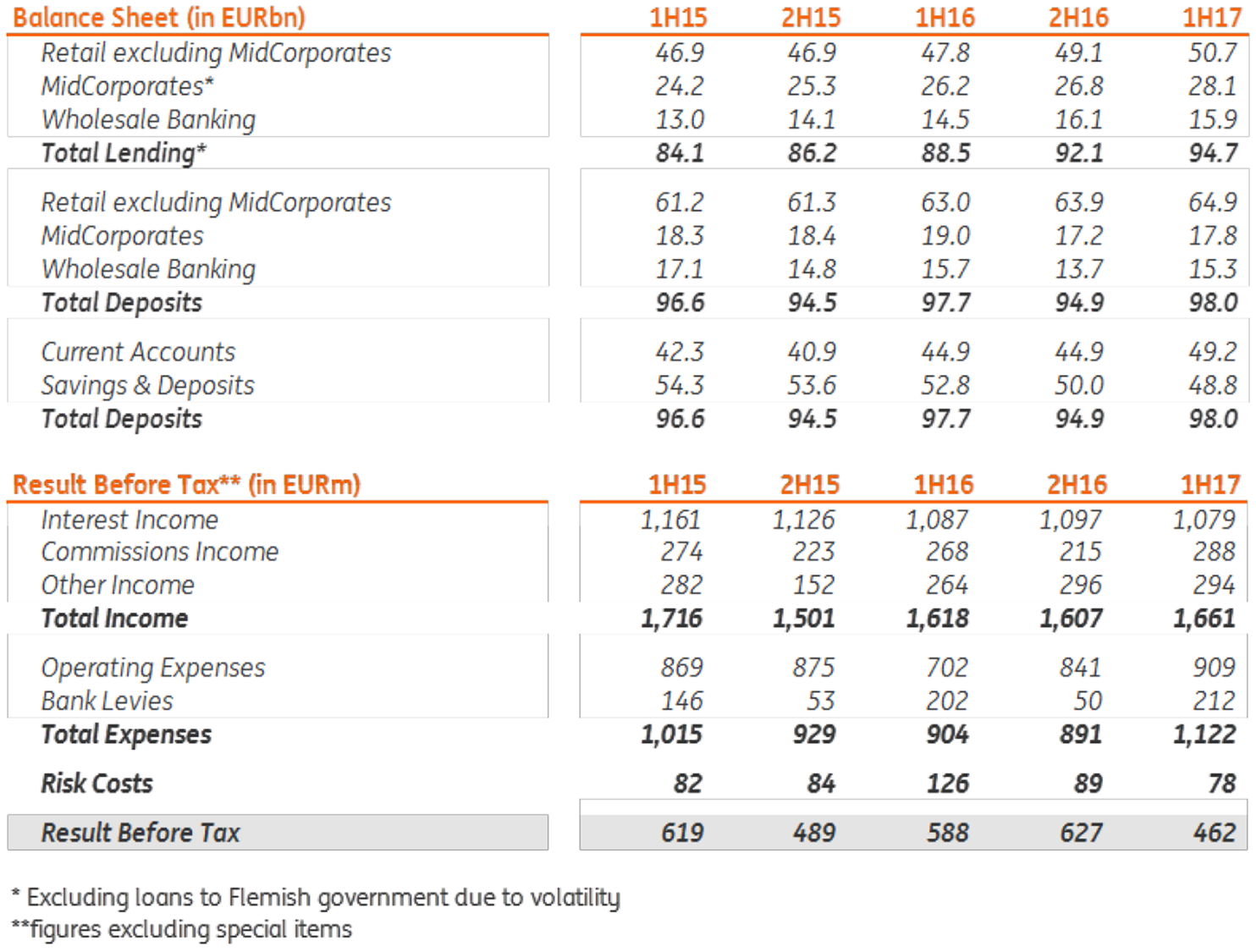

When excluding one-off positive impacts from 2016, pretax half year results of 2017 show a year-on-year 4% increase from € 442 million to € 462 million. The reason for this lies in higher revenues and lower risk costs.

Key financial highlights

First semester 2017 ING BELUX [1] delivered a strong business performance

- € 462 million underlying profit before tax, year-on-year increase of 4% (excluding positive one-off impacts [2] over 1H2016 results)

- € 94.7 billion total lending portfolio. Year-on-year 7.0% or € 6.2 billion increase [3]

- Total deposits at € 98.0 billion, remained broadly stable year-on-year

- Robust solvency and liquidity ratios

- S&P Global ratings raised its long-term credit rating on ING Belgium to ‘A+’ [4]

Key financial figures

When excluding one-off positive impacts from 2016 [2], pretax half year results of 2017 show a year-on-year 4% increase from € 442 million to € 462 million. The reason for this lies in higher revenues and lower risk costs.

Compared to 1H2016 (€ 1,588 million), our 1H2017 total income was 4.6% higher at € 1,661 million (excluding one-off positive impacts from 2016 [2]).

Revenues growth in our commission (+7.6%) and other income (+26.0%) was partly offset by the continuous decrease in our net interest income (-0.7%) due to the low interest rate environment.

- The strong growth in commission income was driven by a stronger demand of clients for investment products due to the low interest environment.

- Other income was driven by stronger performance in financial markets

- Lower interest income due to the impact of low interest rate despite increased income from strong lending growth in 1H2017.

Year-on year ING BELUX supported its customers in realizing their projects by increasing its overall lending portfolio with € 6.2 billion (+7.0%) from € 88.5 billion in 1H2016 to € 94.7 billion [3] in 1H2017.

The growth was well balanced across all business lines and our risk costs (€ 78 million) remained well within our targeted appetite.

When excluding one-off positive impacts from 2016 [2], our expenses increased with 10% from € 1,020 million in 1H2016 to € 1,122 million in 1H2017. This is linked to the investments in preparation for our strategic transformation5 (as announced in 4Q2016) and a one-off legal provision related to a business that was discontinued in Luxembourg around 2000.

At the same time, we note that in 1H2017, the bank levies rose by 5%.

In 1H2017, the total deposits year-on-year remained broadly stable at € 98.0 billion. Coherent with the rest of the market, we continue to see a shift from savings and deposits towards current accounts, driven by record low interest rates on savings and deposit products.

ING Belgium S.A./N.V. maintained high solvency and liquidity, with a Common Equity Tier 1 ratio of 14.5% Basel III, fully phased-in, consolidated basis) and Liquidity Coverage Ratio of 125% (Delegated Act, solo basis).

On July 26, 2017 Standard and Poors Global ratings raised its long-term counterparty credit ratings on ING Belgium S.A./N.V. to from ‘A’ to ‘A+’ based on ING’s “resilient performance and strengthening bail-in-able buffer”. Their outlook on this long term rating is stable [4].

Strategy update

On October 3rd 2016 we announced a transformation plan 2017 – 2021. The first semester of 2017 was marked by preparatory work to enable us to start in the coming period to execute this ambitious plan. Most important fact was that we succeeded in signing a balanced agreement with the social partners on a new set of ‘Collective Labor Agreements’, to frame the execution of the transformation.

Today, we are preparing the redeployment procedure to steer the current organization into the New Way of Working (Agile) from 2018 on. The focus will be on the respectful execution of an ambitious ‘from job to job’ approach for all current employees, either inside or outside ING. This will be executed gradually in the 4 years to come, focusing on maximally reducing the number of lay-offs.

We are working relentlessly on our customer promise to constantly deliver on a differentiating customer experience that is both extremely personal and extremely easy.

Extremely personal and extremely easy for our customers

We want to create a differentiating banking experience for our customers. We believe that the best way to do this is via an omni-channel approach. We want to offer smart and easy services and digital is today the best approach. In addition we maintain and improve the personal relationship with the customer via a new concept of the branch network – the ING Client Houses. And lastly, we foresee Customer Loyalty Teams who offer easy remote services to our customers and thus cover all other remaining customer needs.

In the first half of 2017, we worked continuously to improve the easiness of our services for our customers. We took several successful initiatives.

In the domain of payments we fully rolled-out ING Invoice Solutions [6]. A digital platform that allows SME’s to create and send-out quotations and invoices very rapidly, time track and follow-up and deliver all necessary documents to their accountant.

With ING ePay [7] we are now able to offer small businesses the opportunity to boost their e-commerce activities very easily by simply adding a payment page to their commercial website, fully facilitated by ING. A mix of payment possibilities are offered (Bancontact, Maestro, Visa, Mastercard, …) as well as personal advice and technical support.

In addition, we organized ‘digital ateliers’, workshops throughout the country for customers who are less familiar with new technology. We also simplified the enrollment process for clients to activate their mobile banking app and invested in tools.

The results of these efforts are impressive. Only in 1H2017 we were able to achieve a net growth of approx. 100,000 new mobile banking users up to approx. 660,000 users in total. That’s an 18% increase of mobile users in 6 months.

Innovation can come from within the organization, but we also strongly believe in open collaboration and supporting ambitious start-ups as well. For the second year in a row we hosted the ING Fintech Village, the accelerator for start-ups in the Fintech field. This year, we were able to address a diverse array of solutions. Amongst others: investments, daily banking, insurance, customer interaction management and cyber security. We have tested the proofs of concept and a certain number have shown to be instrumental in creating a differentiating customer experience. They will be integrated in our services.

In addition to the development of easy services, we foresee the opening of the first ING Client Houses in second half of the year and the roll-out of the Customer Loyalty Teams later in 2018. This will further enhance the differentiating extremely personal and extremely easy experience for our customers.

[1] ING Belux includes the ING entities active in banking and leasing in Belgium & Luxembourg, excluding foreign branches.

[2] The 1H2016 € 588 million result was pushed up € 145 million by positive one-off impacts, like EUR 115m of one-off procured cost savings and EUR 30m gain on Visa share sale.

[3] Excluding loans to the Flemish government due to volatility.

[4] www.standardandspoors.com/ratingsdirect

[5] Project may be subject to regulatory approvals.

[6] https://www.ing.be/nl/business/my-business/invoice-solutions

https://www.ing.be/fr/business/my-business/invoice-solutions

[7] https://www.ing.be/nl/business/daily-banking/incomingpayments/epay

https://www.ing.be/fr/business/daily-banking/incomingpayments/epay