ING Belux Full Year Results 2017

In 2017, ING Belux delivers a solid business performance while being on track with the transformation to the new business model and demonstrating robust ratios.

Highlights

Financial results

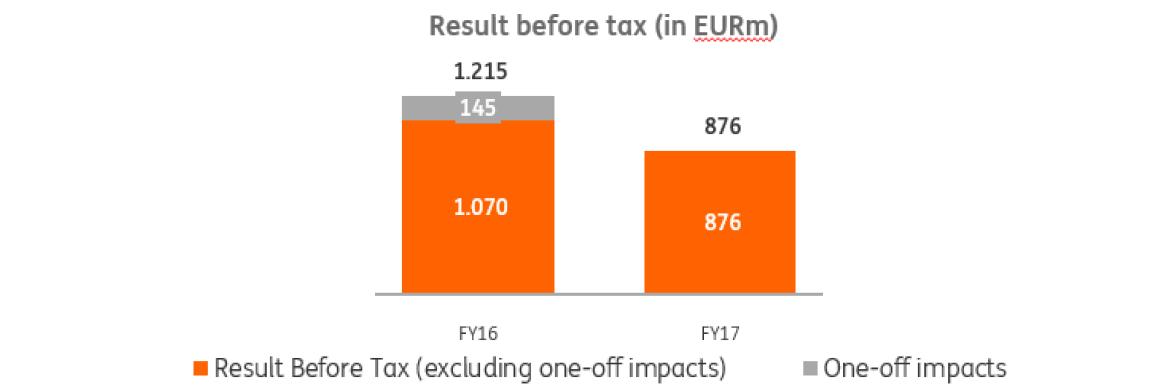

- € 876 million underlying profit before tax.

- Return on Equity at 8.2% impacted by non-recurring items; normalized ROE [2] at 10.6%

- € 97.3 billion total lending portfolio [3]. Year-on-year 5.6% or € 5.2 billion increase.

- € 98.8 billion deposits. Year-on-year 4.1% or € 3.9 billion increase.

- Continued margin pressure on savings and current accounts as a result of the low interest rate environment

- Balance Sheet position remains strong with solid liquidity and capital ratios.

Business performance

- More than 100,000 new ING Lion Accounts.

- Net increase of 32,000 active clients.

- Net increase of 22,000 primary customers.

- Net growth of 225,000 new active mobile users.

New business model

- Redeployment process for 5,000 employees in respectful job-to-job approach.

- 2,200 employees trained and started in the One Agile way of working in January 2018.

- ING Client house - new branch concept launched in Wavre and Bruxelles.

Financial results

Excluding one-off [4] impacts in 2016, year-on-year profit before tax decreased by 18% to € 876 million. This was mainly a result of the increased investments for the delivery of the new business model, continued pressure from the low interest rate environment and a legal provision related to a business that was discontinued in Luxembourg around year 2000.

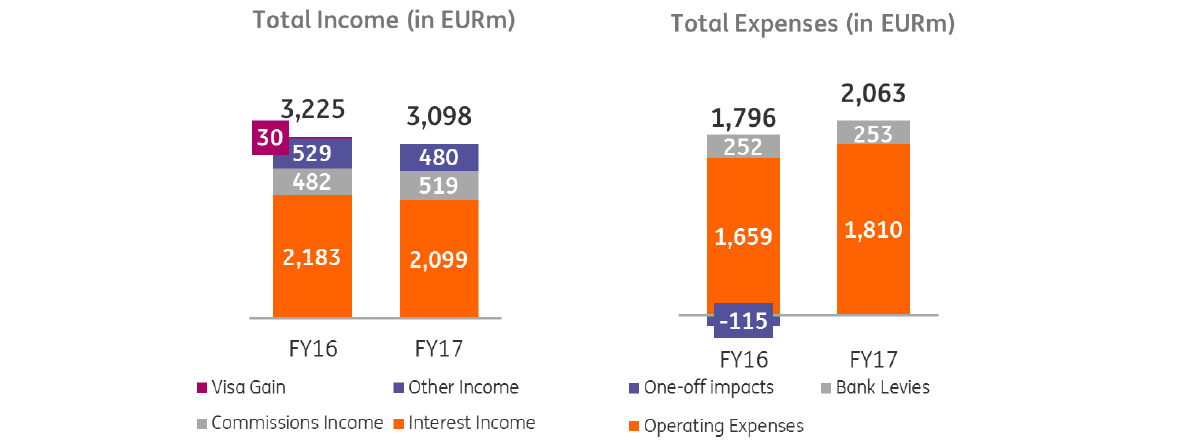

Compared to a historically high 2016, Total Income [5] decreased by € 97 million (-3.0%) from € 3,195 million to € 3,098 million driven by lower margins as a result of the prolonged low rates environment, partly offset by continued lending growth and increased demand for retail investment products by ING’s customers.

The operating expenses have increased by € 151 million (+9.1%) compared to 2016 mainly as a result of the additional investments for the delivery of the new business model (part of € 450 million investments across Belgium and The Netherlands announced in 4Q 2016) and a legal provision related to a business that was discontinued in Luxembourg around year 2000. The increase was partly offset by lower number of internal employees [6] (from 10,190 in 2016 to 9,655 in 2017).

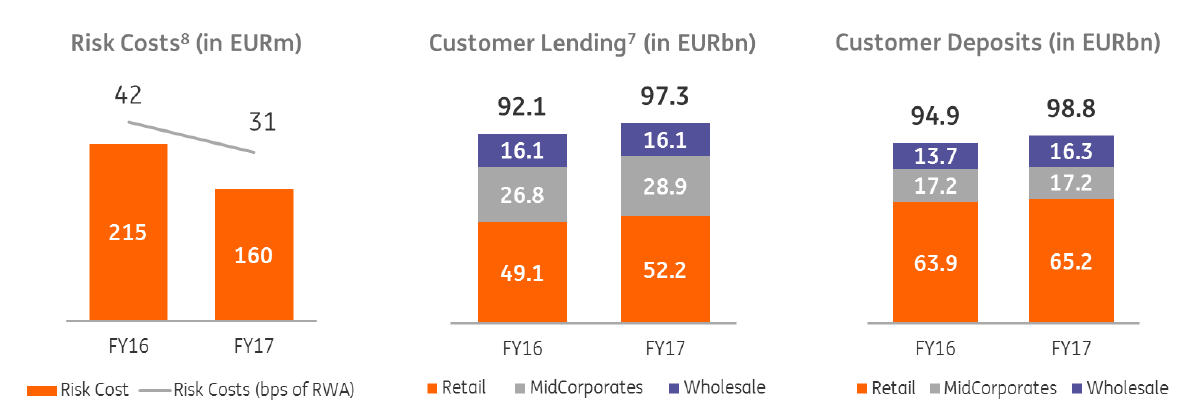

ING’s purpose is to empower people to stay a step ahead in life and in business and we were able to fulfil this promise by increasing the lending portfolio [7] with € 5.2 billion (+5.6%) up to € 97.3 billion. Growth was mainly driven by the MidCorporates and Retail segments reaffirming our customer centricity and leadership in these segments.

Improving economic environment resulted in risk costs of € 160 million in 2017 which were well within our risk appetite and € 55 million below 2016.

The lending growth was funded by € 3.9 billion or 4.1% increase in deposits from € 94.9 billion in 2016 to € 98.8 billion in 2017, maintaining ING’s balanced model and strong liquidity position.

Business performance

The financial results reaffirm the need for ING’s model of the future. With it, the bank will be able to counter the lower interest income by decreasing operating costs and create a differentiating customer experience that will lead to an increased solid income basis in all segments.

In 2017, ING in Belgium (further below referred to as ING) has managed to lay the foundations of this model while at the same time achieving excellent business results:

- Continued success of the free ING Lion Account-formula, with over 103,000 new accounts opened, adding to a total of almost 690,000 (+ 14.96% year-on-year).

- The total number of active clients went up with 32,000 to 2,483,000 (+ 1.30% year-on-year).

- The number of primary customers – meaning customers who have a current account with ING that has regular flows coming in, for instance salary, and at least one additional product - increased in 2017 with almost 22,000 to a total of just under 1,250,000 (+ 1.77% year-on-year).

- Digital adoption, a key pillar for the success of our strategy, is accelerating exponentially. In 2017 a net growth of 225,000 new active mobile users was registered, making a total of 786,000 (+ 40.10% year-on-year).

ING also closed some remarkable deals with some Midcorp and Corporate clients:

- ING was initially approached by Mediahuis in order to advise them on the envisaged delisting of Telegraaf Media Group (TMG). As the deal progressed, ING became the trusted advisor for the acquisition process of TMG, the related acquisition financing combined with Mediahuis’ refinancing, as well as the disposal process of Keesing, one of TMG’s assets. All aspects of the transaction closed successfully, helping Mediahuis to strengthen its leadership position in the NL-speaking media markets.

- In June 2017, Sonaca SA acquired its US-based listed peer LMI Aerospace. ING took the lead in the underwriting, structuring and further syndication of the acquisition financing. Besides, ING was appointed coordinator of all hedging transactions linked to the financing package. This was truly a milestone-deal on Sonaca’s growth path and allows a European company to become a key international player in the consolidating aerostructures part market.

- ING coordinated for bpost the first Belgian syndicated Sustainability Improvement Loan transaction. The terms of this loan are determined in part by the borrower's achievements with respect to the development of its sustainability/Environmental, Societal and Governance (ESG) score. The transaction refinances bpost’ existing 2011 €300m Revolving Credit Facility, aimed for general business purposes.

Smart and personal digital services

Contributing to the differentiating customer experience, ING has delivered extremely easy and extremely personal services by investing in smart and personal digital services:

- Remembering dozens of digital passwords is nobody’s hobby. That’s why ING took on its pioneering and leading role in the development of the itsme app. itsme is the first digital identity to potentially replace all passwords on the web. It allows smartphone users to sign in online and approve bank transactions as well as many other services that require passwords or card readers. In the meantime, other companies, such as other banks and service providers are increasingly participating in this innovative service.

In the new Self’Service Corner within Home’Bank and the Smart Banking app, the customers of ING can easily manage a variety of online services like downloading account statements, setting up standing orders, collecting tax certificates and many more.

- With alerting, ING adds a functionality to the Smart Banking app to increase the personal aspect of our digital services. The customers are able to receive alerts when a chosen amount is being removed from or added to their accounts. The functionality was piloted in 2017 and will be rolled out in the beginning of 2018.

Innovation through partnership

Innovation can come from within the organization, but we also strongly believe in open collaboration and supporting ambitious start-ups as well. For the third year in a row ING Belgium is hosting the ING Fintech Village, the accelerator for start-ups in the Fintech field. The second edition has ended in 2017 and ING is now selecting the candidates for the third edition. Proofs of concept will be tested and solutions which are instrumental in creating a differentiating customer experience will be integrated in our services.

New business model

2017 was of course marked by the start of the transformation towards the new business model. For every individual at ING, it was an intense year.

Redeployment process on track

5,000 colleagues were in scope of the redeployment process. Those who applied for a function in the new business model had an interview and received feedback about their application before the end of the year. ING strived for a maximal number of matches, which has so far resulted in almost 90% being matched. While employees could apply for several positions, 70% have received their first choice.

ING’s commitment to reduce as much as possible the number of dismissals is a success. Several options have been developed to allow people to leave the company. For the employees who are not retained after the redeployment procedure, ING developed together with the unions the Job Accelerator, a series of specific accompanying measures (job fairs, workshops and personalized off-boarding tracks) to help them find a job whether inside or outside ING. Nearly half of employees who went through the program, have a clear outlook on a new employment of which 17% within ING.

In short:

- 138 have left the organization by means of the ‘early leave’ measure (55+), another 759 have decided to make use of this arrangement before the end of 2021.

- 55 employees have decided to ‘start their own business’ with ING support.

- 448 employees were granted voluntary or recognized leave.

- ING was able to limit the number of dismissals to 120 in 2017.

In 2017, 272 people have been hired externally. This is mainly in areas where new competences are created.

Training employees in the One Agile way of working

In 2017, 2,200 employees were trained on the principles of the One Agile way of working. Each participant engaged in three days of role play to get experienced with the agile mindset and methodology. This to prepare them for the Agile way of working that is the norm for the delivery organization of ING as from January 2018.

This new way of working has as a consequence that teams are organized in a completely different way with Agile squads instead of hierarchical vertical structures:

- Autonomous and self-steering

- Maximum nine multidisciplinary members

- Advantage that innovation can be deployed more quickly for customers.

New distribution model

Bankers fully focused on advice

The launch of the new retail organization will be in effect as from March 2018. It will allow ING to change the direction of our branch concept 100%, with the local bankers fully focused on advice. And with added flexibility, where customers are able to talk to bankers from 08:00 am to 08:00 pm. In complex matters where emotional intelligence, creativity and empathy are essential, the difference is and will be made via personal contact with the banker. The bankers in the branch network and elsewhere thus continue to play a crucial role, but not for transactions such as requesting modification of existing professional credits and adding guarantees for an insurance. These transactions are being removed from the branch network and relocated to the Customer Loyalty Teams.

Revision of the branch network

On October 19th, the first ING Client House was officially opened in Wavre. A new branch concept that illustrates the strategy. It aims to be a reflection of what is happening in society: on one hand there is far-reaching digitization, but on the other hand there is also an undeniable urge for personal contact and local anchoring. The ING Client House is the response to the rapidly evolving society and customer needs.

In the meantime a second ING Client House was also opened in Brussels. For 2018, ING aims to open 5 new ones. By 2020, there will be 10 to 15 ING Client Houses.

Around April, Record Bank will join forces with ING. 71 agents will be joining ING as independent agents and 118 have concluded an amicable settlement based on the code of conduct we drew up following our many discussions with the organizations representing the interests of the banking agents in the financial sector.

The migration for the large majority of the Record Bank customers will take place automatically A detailed onboarding plan is in place. They will experience a larger network coverage and an improved service through the use of the digital ING platform.

Customer Loyalty Teams

With the Customer Loyalty Teams (CLT’s), ING is also aiming resolutely for a differentiating customer experience. When a customer phones up or uses the chat system, he or she is in contact with one of the 1,300 available staff members, who handles his or her request from start to finish. And this from 08:00 to 22:00. Being transferred to multiple departments will be a thing of the past. This constellation has been running successfully in pilot projects over the course of 2017. The deployment of the CLT’s will take place as from March 2018.

[1] ING Belux includes the ING entities active in banking and leasing in Belgium & Luxembourg, excluding foreign

branches

[2] Normalized by excluding the impacts of the non-recurring items

[3] Excluding loans to Flemish government due to volatility

[4] 2016 positive one-off impacts include EUR 115m of one-off procured cost savings (lower expenses) and EUR 30m gain on Visa sale (higher revenues)

[5] Excluding impact of EUR 30m gain on Visa sale in 2016

[6] End of period Internal Full Time Equivalents including allocations of Head Office functions

[7] Excluding loans to Flemish government due to volatility

[8] Basis points of Risk Weighted Assets