ING Belux Full Year Results 2016

Resilient commercial results in a challenging market environment.

Due to the ongoing dialogue with the social partners on the intended transformation, for the time being ING Belgium will deter from any external statements on this topic and give priority to the internal dialogue towards the social partners and the employees of ING Belgium.

Highlights

Over 2016, ING Belux [1] delivered an overall good business performance in a very challenging environment

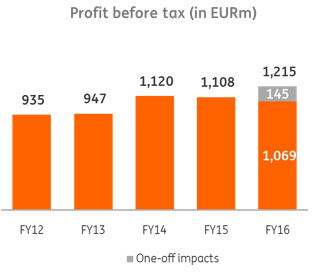

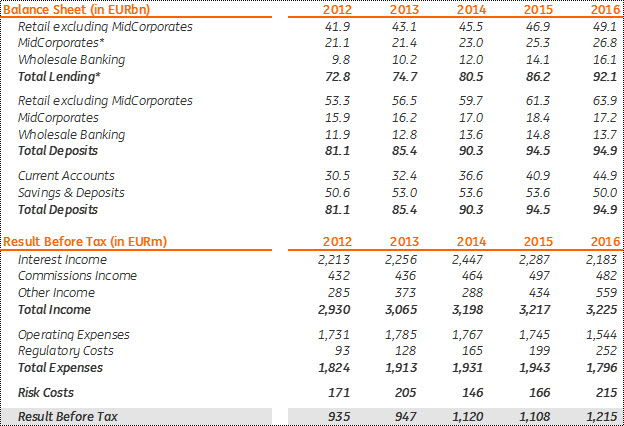

- € 1,215 million underlying profit before tax. Year-on-year 10% or € 107 million increase.

- Excluding € 145 million positive one-off impacts [2], profit before tax decreased by 3% or € 39 million to € 1,069 million.

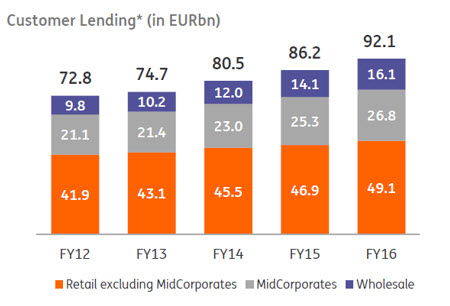

- € 92.1 billion total lending portfolio. Year-on-year 7% or € 5.9 billion increase [3].

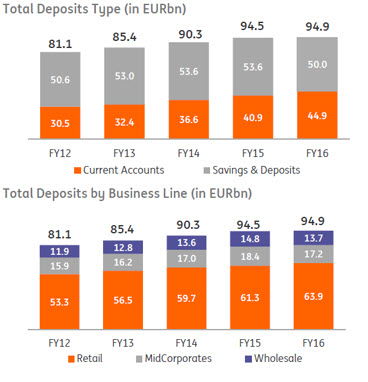

- € 94.9 billion deposits. Year-on-year 0,4% or € 400 million increase.

- € 252 million bank levies paid [4]. Year-on-year 27% or € 53 million increase.

- Robust loan-to-deposit ratio of 97%.

- This year we welcomed 158,000 new clients at ING in Belgium and 42,000 new clients at Record Bank.

Key financial figures

Year-on-year the profit before tax increased by 10% to € 1,215 million. However, it is important to note that this strong result was supported by a number of positive one-off impacts.

When excluding these one-off positive impacts, pretax results show a year-on-year 3% decline to € 1,069 million. Challenging market circumstances (continued low interest rates, higher bank levies, changing customer behavior, …) have an impact on our core earning model and underlying results.

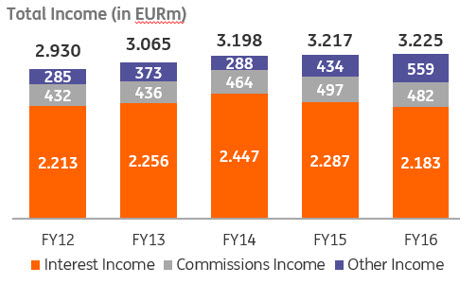

Compared to 2015, our 2016 total income was stable at € 3,225 million. The decrease in our net interest income due to the low interest rate environment and decrease in our investment product commissions revenues, was fully offset by strong lending revenues growth and other income impacts.

Both our commission and interest income showed a year-on-year decrease.

- We saw that the continued low interest rate environment starts to weigh on our net interest income, despite strong commercial performances in, for example, retail mortgages.

- We also see the impact of the continued mortgage refinancings, which offers positive one-off impacts on the short term due to refinancing fees, but structurally increases the pressure on our long term interest margins.

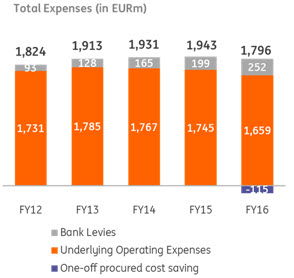

ING Belux managed to decrease underlying operational expenses by almost 5% from € 1,745 million in 2015 to € 1,659 million in 2016 – driven by strict cost discipline and lower FTEs.

At the same time, we note that over 2016, the bank levies rose by € 53 million to an all-time high of € 252 million, representing a 27% year-on-year increase.

ING Belux supported its customers in realizing their projects by increasing its overall lending portfolio with € 5.9 billion (+7%) to € 92.1 billion [5].

The growth was well balanced across all business lines with particularly strong targeted growth in the corporate segments; while the important Retail lending portfolio remained resilient with a 5% increase from € 46.9 billion to € 49.1 billion.

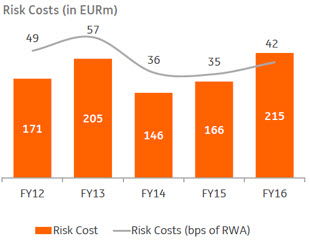

Over 2016 risk costs increased by € 49 million, partly driven by our MidCorporate and Wholesale segments, but remains within our risk appetite. By increasing our business lending portfolio, we support the real economy. This anticipated increase of our lending portfolio shows we put our capital at work for our customers.

Total Deposits remained relatively stable throughout 2016 with a growth in retail deposits in line with previous years. Coherent with the rest of the market, we also saw a shift from savings and deposits towards current accounts, driven by record low rates on savings and deposit products.

Our loan to deposit ratio remains robust at 97%.

Moreover, as in previous years also in 2016 ING is one of the biggest corporate tax payers in Belgium with € 384 million incurred in income taxes.

Resilient commercial results in a challenging market environment

ING Belux delivered a good business performance, notwithstanding the many challenges during 2016.

Banking for private individuals:

We systematically improved our customer service offering over 2016, including:

- We launched a new online ‘Investment Product’ tool allowing our clients to search in an easy and intuitive online environment for investment product proposals that match their needs and profile. The traffic and the engagement with the tool is very high, which proofs that the tool meets a real need of our customers.

- The onboarding of new clients was further improved. As from 2016, it is possible to become a client without going to a branch: 100% digital and easy.

- The continuous improvement of the digital channels in 2016 led to some noteworthy improvements in both the mobile and online banking environment with new end-to-end digital sales possibilities like e.g. new credit card contracts; a new release of ‘Home’invest’, allowing customers to have an easy overview of their investments in their smart banking application; new cross channel capabilities by using text message notifications in the digital process flow, etc.

The success of our free ‘ING Lion Account’ formula also continued in 2016, with more than 100,000 new accounts opened.

Banking for professional clients and businesses:

In 2016, ING Belgium has taken several initiatives to strengthen its position as primary banker for business clients: from the independent professional without employees and ambitious SME’s to large multinationals and public institutions, including:

- After a thorough testing period, in 2016 the ‘ING Welcome Team’ process was fully implemented for legal entities in the ING approach for SME’s and large corporates. New business clients now feature a fast (5 days), clear, easy and transparent onboarding process.

- In the domain of payments we implemented ‘ING invoice solutions’. A digital platform that allows SME’s to manage their invoice payment flow fully digitally and to align with their accountant.

- Introduction of ‘business bankers’ in 2016. As from now, every business client can count on the support of a personal business banker who understand the clients’ business and aspirations.

Innovation:

On the crossroad where innovation and business banking meet, ING Belgium realized in 2016 its plan to pioneer with the ING FinTech Village accelerator for start-ups with a big idea in finance technology. Coached by an expert ING banker and supported by firms like Deloitte, SWIFT Innotribe, IBM, Eggsplore and others – 7 start-ups got the opportunity and means to really accelerate their business. In the meantime, 10 new FinTech start-ups were selected to participate in the 2017 edition of our accelerator.

In the spirit of the ING FinTech accelerator, at the end of 2016 ING Belgium also launched, together with crowfunding platform KissKissBankBank Creatis – a new start-up accelerator at the ING Art Center in Brussels, focused on the creative sector.

In 2016 ING joined forces with KBC to launch an unique integrated loyalty platform in Belgium: ‘Joyn’. This open application combines the loyalty platforms Qustomer and CityLife. Joyn will be the biggest Belgian loyalty program connecting 1.4 million users with more than 4,000 merchants.

Moreover, last year ING was also one of the major driving forces behind the launch of the new and innovative mobile payment application Payconiq. By the end of 2016 already more than 16,000 merchants offered Payconiq as a payment solution for their customers.

[1] ING Belux includes the ING entities active in banking and leasing in Belgium & Luxembourg, excluding foreign branches

[2] One-off impacts include EUR 115m of one-off procured cost savings and EUR 30m gain on Visa sale

[3] Excluding Flemish government due to volatility

[4] Bank levies include levies paid on client deposits and contributions to Deposit Guarantee Schemes and Single Resolution Mechanism Fund

[5] Excluding Flemish government due to volatility