ING Belgium’s franchise shows its strength amid difficult market conditions in the first half of 2022 recording a €294 million profit before tax (excl. one-offs)

- ING Belgium posts this result in an uncertain market environment as we face geopolitical conflicts, concerns about energy security, inflation rising to unprecedented levels and an impending recession.

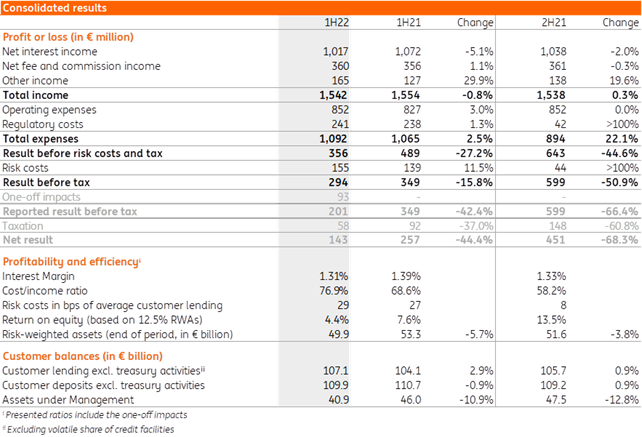

- With €1,542 million in total revenue, commercial momentum continues to hold up well. The negative trend in interest income seems to be bottoming out and commission income remains resilient, despite the difficult markets for investment products. Deposit and loan volumes also showed an upward trend in the first half of the year.

- The ongoing push for operational efficiency is clearly visible. The 3% increase in expenses is well below the inflation and wage indexation rates observed in the first half of 2022.

- ING Belgium has increased its loan loss provisions by €155 million.

The economic and geopolitical context has sent shock waves in the first half of 2022. Among other things, the economic outlook has deteriorated due to rapidly rising inflation, the Russian invasion of Ukraine and concerns over gas supplies, which has led to an explosion in energy prices. Undeterred, ING Belgium has continued to press on with its Route24 strategy, expanding its digital platform, launching new products and strengthening branch teams to provide more and better focused expertise. These investments make banking simpler and easier for the customer resulting in greater customer satisfaction. ING Belgium continues to prepare for the future and books a restructuring provision anticipating the consolidation in its independent agents network.

"These difficult market conditions are also weighing on our results. However, ING Belgium delivers solid results despite the difficult environment. The hard work of our people and the investments made to achieve the objectives of our Route24 plan are paying off. ING Belgium's strategy to make banking simple again, which translates into new, efficient services and products, and the further broadening of our digital solutions offering, is clearly appreciated by customers." Peter Adams, CEO of ING Belgium

ING Belgium reports an underlying result before tax of almost €300 million

In the first half of 2022, ING Belgium reported a result before tax of €294 million, or €201 million including €93 million restructuring provisions.

“Since the start of the year, the Russian invasion and the subsequent economic downturn has led to increased loan loss provisions. Unprecedented inflation has increased cost pressures and difficult stock markets and recession fears have had an adverse impact on our commission income from investment products. The saying that “when the going gets tough, the tough get going”, describes best what our ING Belgium colleagues did in the first half of 2022. I’m proud and grateful to show a robust set of financials, a demonstration of the intrinsic strength of our franchise.’ Hans De Munck, CFO of ING Belgium

Total income remained resilient and is €12 million lower compared to 1H21, which benefitted strongly from the temporary favourable funding conditions offered by the ECB (TLTRO). Excluding TLTRO, interest income is bottoming out, as increasing market rates ease the margin pressure on current accounts and saving products. Moreover, fee income remains strong, as higher fees from current accounts offset the lower fee income on investment products, following recent stock market developments. Other income is strongly up, thanks to financial market and treasury-related activities.

Operating expenses amounted to €852 million. This is 3% higher than last year, but well below the observed inflation and wage indexation rates, thanks to strict cost management and Route24 initiatives. Risk costs were €155 million, which is equivalent to 29 basis points of average customer lending.

In the first half of 2022, ING Belgium issued €9.5 billion in new loans compared to €9.2 billion in the same period last year. Thanks to this new business, the upward trend in the outstanding lending portfolio continued, ending €1.4 billion higher compared to December last year, mostly fuelled by business lending. Customer deposits also showed a positive development, increasing by €0.7 billion compared to December, primarily in current accounts.

ING Banking app: we continue to expand our digital services offering

ING’s investments and continued efforts to make digital and remote banking as easy as possible are paying off.

The majority of the most frequently used banking services are today available digitally, and the digital services platform continues to expand. For example, retrieving the PIN number for a debit or credit card or increasing the limit on a credit card can now be easily done via the app. A customer can also make a consumer credit application quickly and easily through the app. Another new feature is that ING Belgium customers no longer need a card reader to authorise their online purchases. They can now do it on a smartphone or tablet via itsme®, quickly, safely and easily. Our customers appreciate our digitalisation efforts, as shown by the high user ratings and the increased usage of the many digital services and solutions offered by ING Belgium. During the first six months of this year, ING Belgium registered 332 million user sessions, a 13% increase compared to the same period last year.

"The further expansion of our digital services offering in the app may seem at first sight to be simple solutions and additions, but they lead to a more efficient and faster service. This not only improves customer satisfaction, but also frees up time for our bankers to answer questions from customers and to support them with advice and specialised services." Peter Adams, CEO of ING Belgium.

Customers increasingly rely on Self Invest

During the first half of the year, customers opened just under 10,000 new Self Invest accounts. We noticed that, despite the war in Ukraine and the turmoil on the markets, our customers generally held on to their portfolios, rather than selling their investments.

Furthermore, we redesigned ING Invest Advice to offer even more value, also for first-time investors who want to begin investing in a smart way.

"In spite of the rather turbulent market due to geopolitical developments, the simplicity of Self Invest has convinced many new customers. We firmly believe in its potential and this is proven by the interest that our customers show in our investment offering. We therefore continue to invest in the expansion and further improvement of Self Invest." Peter Adams, CEO of ING Belgium.

Instant Business Lending makes it easier to apply for business credit of up to €100,000

With the launch of Instant Business Lending, initially made available for a limited group of Business Banking customers, customers can apply for a loan of up to €100,000 in less than five minutes, and receive a decision immediately. Following approval, the money appears in their account the next working day. Simple and fast, enabling entrepreneurs to be on the ball and make quick decisions for limited investments such as a new vehicle, equipment or additional working capital.

Sustainability is embedded in everything we do as a bank

Sustainability is more than reducing your ecological footprint. As a bank, ING wants to facilitate and finance sustainability efforts in Belgium. Sustainability is at the heart of our business; it is embedded in everything we do as a bank.

The number of sustainability-linked financing transactions doubled in the first half of the year compared to the same period last year. To respond to the rising demand and the increasing importance of sustainability, ING Belgium extended its product offering for large corporates with a Sustainable Improvement Derivative.

Our sustainable offering is also growing in the Retail segment. Within our increasing consumer lending portfolio (+9%) over the past six months, the share of sustainable loans has more than doubled (9% vs. 4% in 1HY2021). This represents an increase in ecological loans of no less than 140%.

ING Belgium is also reducing its own footprint with the extensive renovation of its iconic modernist headquarters on Avenue Marnix. After this renovation, due to be completed by the end of 2024, the Marnix building will meet the most ambitious climate and sustainability targets.

"ING Belgium is determined to become a leader in building a sustainable future by leading by example, helping our customers in the transition towards a low-carbon society and by encouraging employees to reduce their own environmental footprint. Now that we are making progress on our Route24, the time is right to fully embed this theme into our strategic plans." Peter Adams, CEO of ING Belgium.

Press release 1HY 2022 ING Belgium

PDF - 208 Kb

%2007-03-2022-2.jpg)

%2007-03-2022-4.jpg)