ING Belgium successfully continues its growth strategy, reporting robust half-year results driven by a more diversified income and an intensified focus on the customer

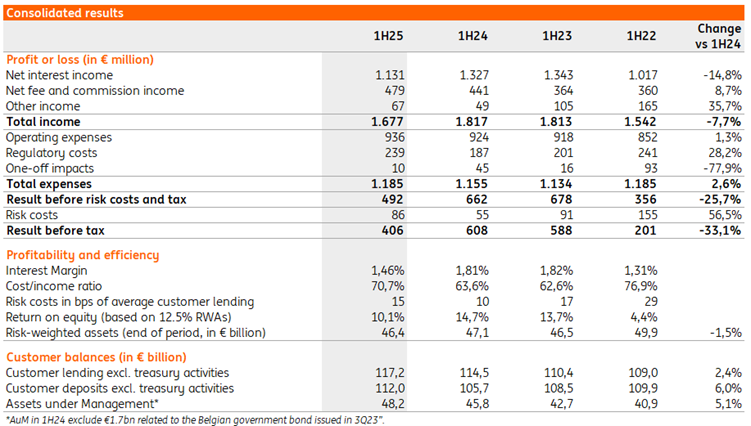

ING Belgium closed the first half of 2025 with a pre-tax profit of €406 million. With a total income of €1,677 million, the bank continues its strong performance of last year. Not only has ING maintained its strong commercial results, but it has also successfully pursued its strategic focus on diversification and sustainable customer relationships. In this first half of the year, the bank once again continued to gain market share with a year-on-year increase in both deposits and loans. This growth strengthens the bank’s ability to do what it does best: financing the Belgian economy. In a less favourable interest rate environment and geopolitically uncertain context, the bank thus affirms its position as a stable and customer-centric player.

“Our results demonstrate that we have chosen the right strategy. Our services and products are more user-friendly and accessible, an evolution that clearly resonates with our customers”, says Peter Adams, CEO ING Belgium.

Growth in all customer segments continues, amid challenging environment

Commercial dynamics remain strong. The bank has increased its market share across all segments, in both loans and deposits. ING closed the first half of the year with €112 billion in deposits, a year-on-year increase of €6.3 billion. This growth has largely been driven by the successful September 2024 promotional term accounts campaign, which further strengthened customer confidence in the bank. However, this growth was not limited to the end of 2024, it also continued into the first half of 2025 with an increase of €2.4 billion.

Despite a challenging start to 2025 for stock markets, investors continued to turn to ING’s investment solutions. Assets under Management rose by €2.4 billion year-on-year, reflecting a growing interest in investment solutions and a further shift towards long-term customer relationships. Within the retail segment, the use of advisory solutions increased by 70%. Against a backdrop of low interest rates, investment products remain the most suitable way for customers to preserve their purchasing power and to beat inflation. Furthermore, the bank aims to make investing accessible to everyone, which is why it introduced ‘ING Invest Up’ at the beginning of 2025. This entry-level formula is attracting interest, confirming the need for accessible investment solutions.

In a Belgian economy that needs stable credit providers, the bank continues to fulfil its role by converting deposits into loans that stimulate the economy and by investing in projects that add value for customers and society. This resulted in a growth in the loan portfolio of €2.7 billion making it €117.2 billion, primarily driven by strong corporate demand and a recovering mortgage market. With this, the bank has further strengthened its market share and outperformed the market. “Our country needs strategic investments in technology, sustainability and defence. As a bank, we want to do more than our fair share. We promised that we would, we are delivering on that promise, and we will continue to do so. That is our pledge going forward”, confirms Peter Adams.

Diversification of income pays off

Total income of the bank reached €1,677 million, continuing its strong performance of recent years. At €1,131 million, the bank’s interest income fell by 14.8%, largely due to the interest rate cuts initiated by the ECB in the second half of 2024. However, this decline is fully in line with expectations and was partly offset by a notable increase in fee income of 8.7%. This strong growth was driven by increased activity in investment products, higher sales of insurance products across the Private Individuals, Private Banking and Business Banking segments, and a sharp rise in fees within the Financial Markets department of Wholesale Banking.

Hans De Munck, CFO ING Belgium, explains: “The profit for the first half of 2025 is strong despite a less favourable interest rate environment. With this result, we are building on the momentum from last year. A strategic focus in this first half of the year was the increase in our fee income through a successful shift towards investments. This diversification of our income makes us more resilient and better equipped to withstand declining interest rates, and it enhances the overall quality of our profit.”

Costs under control, risks manageable

Thanks to the bank’s ongoing pursuit of efficiency gains, the rise in operating expenses has remained limited, even during its business growth phase. With an increase of only 1.3% compared to 2024, the evolution of operating expenses remains well below the inflation level.

At the same time, risk costs remain relatively low at €86 million, even amidst geopolitical unrest and macroeconomic challenges. “Uncertainty in the external environment is increasingly considered to be business as usual”, notes Peter Adams. “It is no longer producing structural shocks; markets are still reacting but at the same time, they are recovering quickly. For us, it is crucial that we can be and remain a beacon of stability and continuity for our customers. The structurally greater uncertainty also has a disciplining effect, both on our customers’ investment decisions and on our own assessment of credit applications.”

Targeted growth with a customer-centric approach

The bank has successfully completed its previously initiated transformation, which focused on improving its cost position and further strengthening its digital capabilities. “These figures are no coincidence; they reflect a strategy that we are pursuing, and which has been more successful than anticipated. Over the past few years, we have prepared the bank for further growth and this is reflected in the figures”, states Hans De Munck. With ‘Together for Progress’, the bank is now embarking on a new chapter in its strategy. As of this year, Private Banking has become a separate business line within the bank, with additional investments in the recruitment of private bankers and the enhancement of the proposition to the customer. This once again underlines ING’s ambition to be an investment bank for its customers, thereby advancing the bank’s income diversification strategy.

As a bank, ING continues to innovate with one clear focus: making customers’ lives easier. The bank develops solutions that unburden, protect and support customers in a rapidly changing world. For example, the ‘Check the call’ feature helps customers identify fraudulent calls, better protecting them against fraud. For self-employed and SMEs, the bank launched ‘ING Invoice Manager’, a user-friendly solution that not only helps them comply with new e-invoicing legislation but also simplifies the interaction with their accountant.

Customer centricity continues to be of the utmost importance:

“We have welcomed a significant number of new customers since September 2024. We serve them, get to know them better and better, and that ultimately translates into strong results for the bank. We are looking forward with confidence to a healthy second half of 2025, in which we will continue to build on our strong customer ties”, concludes Peter Adams.

Peter Adams, CEO ING Belgium

Hans De Munck, CFO ING Belgium

Daphne Poets

About ING

ING Belgium is a universal bank that offers financial services to private customers, companies and institutional clients. ING Belgium SA/NV is a subsidiary of ING Group NV via ING Bank NV (www.ing.com).

ING is a global financial institution with a strong European base, offering banking services through its operating company ING Bank. The purpose of ING Bank is: empowering people to stay a step ahead in life and in business. ING Bank’s more than 60,000 employees offer retail and wholesale banking services to customers in over 100 countries.

ING Group shares are listed on the exchanges of Amsterdam (INGA NA, INGA.AS), Brussels and on the New York Stock Exchange (ADRs: ING US, ING.N).

ING aims to put sustainability at the heart of what we do. Our policies and actions are assessed by independent research and ratings providers, which give updates on them annually. ING’s ESG rating by MSCI was reconfirmed by MSCI as ‘AA’ in August 2024 for the fifth year. As of December 2023, in Sustainalytics’ view, ING’s management of ESG material risk is ‘Strong’. Our current ESG Risk Rating is 17.2 (Low Risk). ING Group shares are also included in major sustainability and ESG index products of leading providers. Here are some examples: Euronext, STOXX, Morningstar and FTSE Russell.

%2007-03-2022-1%20crop.jpg)

%2007-03-2022-1.jpg)

.jpg)