ING Belgium revises pricing to reflect market conditions and continues to invest in digital value-added services for its customers

Tuesday, 20 April 2021 - Brussels - As of 1 July 2021, ING Belgium will amend the fees on the ING Lion Account and Green Account and will lower the threshold above which a negative interest rate of -0.50% is calculated to 250,000 euros. Customers will be personally informed of the changes as of 20 April 2021. These changes are reflecting the current market circumstances of low and negative interest rates, the higher regulatory costs and continuous investments to meet the customers’ current and future expectations.

ING Lion Account and Green Account rates reviewed

ING Belgium has decided to review the rates of two current accounts to amongst others better reflect the ongoing investments in value-added services included in the daily banking packages.

Recent examples of these services integrated in the daily banking offer of ING, without additional costs for ING’s customers, are:

- cashbacks with ING+ deals for more than 250,000 customers which generated an average of 27 euros for its users in 2020;

- ING’s subscription manager OneView, which generates substantial savings for participating customers. One in ten users cancelled at least one subscription during the pilot phase which translated into an average yearly savings of about 400 euros;

- Switch, an additional feature in OneView, which allows customers to compare their energy supplier or mobile provider with better alternatives on the market and to make the switch immediately;

- and free instant payments for private individuals with about 34 million outgoing transfers in 2020.

Starting 1 July 2021, a monthly fee of 1,90 euros will be charged for the Lion Account. This pricing change does not apply to the Lion Account holders between 18 and 25 years old.

The Green Account will now be monthly charged by 4,50 euros, or a total of 54 euros per year (instead of 44 euros per year).

All customers with these accounts have full access to ING’s online and mobile services, as well as access to personal advice by ING’s bankers.

No negative interest rates for more than 97% of all ING Belgium customers

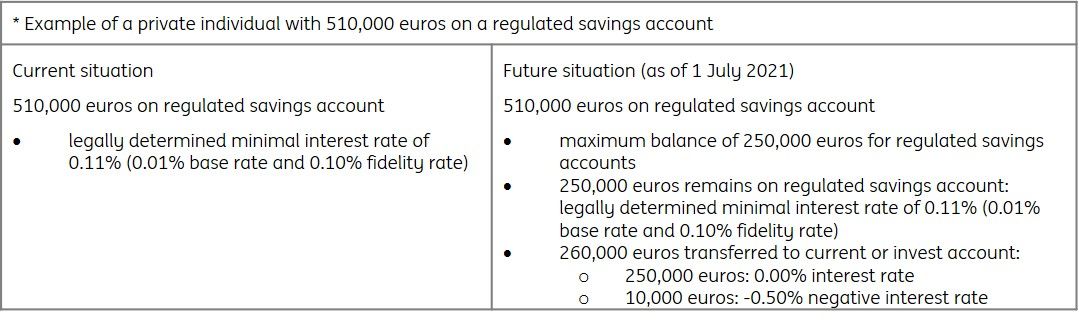

On 1 July 2021, ING will lower the threshold from 1 million euros to 250,000 euros, above which a negative interest rate of -0.50% will be applied (* see example in table below). The threshold change is a consequence of European and Belgian market conditions, market interest rate trends and customer savings behaviour.

For balances of up to 250,000 euros on regulated savings accounts (for private individuals only), the legally determined minimal interest rate of 0.11% (0.01% base rate and 0.10% fidelity rate) will be maintained.

The lower threshold will have no impact for more than 97% of all its business and private customers. At this moment, less than 2.5% of business customers and less than 0.5% of private individual customers have a balance of more than 250,000 euros per account.

ING Belgium believes it is important that customers, both private and business, continue to have a financial buffer for unforeseen expenses. Alternatives to avoid negative interest rates include diversification by means of investments in financial instruments, property and other forms.

ING Belgium is informing all its customers in accordance with legal requirements.

PR_20042021_EN.pdf

PDF - 112 Kb

Infographie_20042021_EN.pdf

PDF - 57 Kb