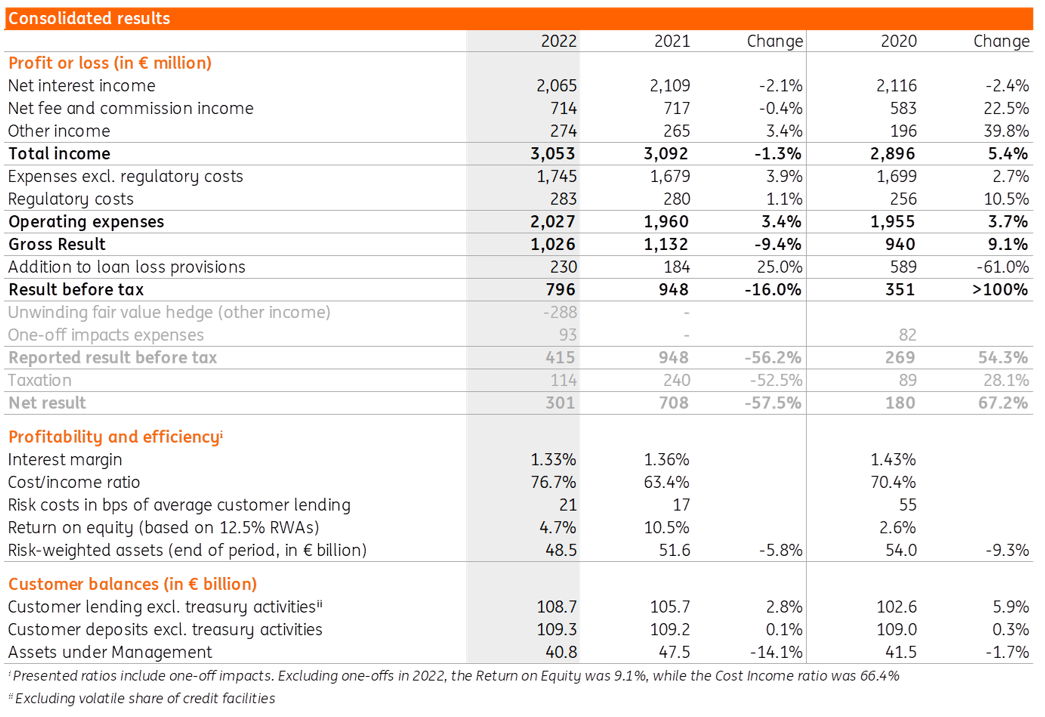

ING Belgium posts solid results in challenging economic environment: underlying profit of €796 million before tax

Reported result before tax comes in at €415 million due to one-offs

- With over €3 billion in total income, the bank maintains its commercial momentum.

- The cost base increases (+3.4%), but remains well below inflation.

- Loan loss provisions end at €230 million, which is €46 million higher compared to 2021.

- Despite the geopolitical context, the uncertainty over energy supplies, increasing energy prices and high inflation, ING Belgium has held up well over 2022 and reports an underlying profit before tax of €796 million.

- The fast-rising market rates led to the recognition of an interest rate hedge with an asymmetric negative accounting impact of €-288 million. The mirroring positive impact of €288 million will be recognised over the coming years.

- In view of the further optimisation of its network of independent agents, ING Belgium books a provision of €93 million.

- Digital banking and remote advice are the new norm.End of 2022 ING Belgium announced a substantial rate increase positioning the bank at the front of the pack in the savings market.

ING Belgium posts solid results over 2022, despite many challenges in the market. Those hurdles did not stop ING from pressing ahead with the rollout of its Route24 strategy, the strategic plan to make banking simple again.

The building blocks for the bank of the future are in place and these efforts are bearing fruit. We revisited the core of our business last year to make our services and products more user-friendly, smooth and accessible. Our customers clearly appreciate this evolution. Peter Adams, CEO of ING Belgium.

ING Belgium reported an underlying result before tax of €796 million for 2022. The reported result before tax finished at €415 million because of two exceptional items.

First, the announced optimisation of the independent branch network gave rise to a provision of €93 million. Secondly, the fast-rising market rates led to the recognition of an interest rate hedge with an asymmetric negative impact of €-288 million. The mirroring positive impact of €288 million will be recognised over the coming years.

The unprecedented events in 2022 remind us why it is so important for us to continue our efforts to build that solid bank that is fit for the future. These 2022 events give rise to some important non-recurring items in our results, but when I look through those, I see a strong and diversified income base and expenses that are contained well below inflation. Hans De Munck, CFO of ING Belgium.

Income above €3 billion for second year in a row

With a total income for 2022 of €3,053 million, ING broke the 3 billion mark for the second year in a row.

The higher interest rates observed in the second half of 2022 benefitted the bank’s interest income on deposits. Net interest income, however, ended lower than in 2021 owing to the ECB decision to terminate favourable funding conditions from the TLTRO early.

Both bond and stock markets underperformed in 2022, which weighs on fee income from investment products. The fact that fee income nonetheless remains at elevated levels testifies to the efforts ING Belgium made to diversify its commission income base.

Operating expenses end at €1,745 million. The cost base increased 3.4% vs. last year. However, this is still well below the inflation and wage indexation rates, thanks to strict cost management and efficiency gains from Route24 initiatives.

Loan loss provisions end at €230 million, which is €46 million higher compared to 2021, mostly reflecting the additional provisioning for the bank’s Russia-related exposure.

€19.2 billion in new loans was issued, an increase of customer lending by €2.9 billion compared to 2021. The growth was fuelled by both business lending and mortgages.Customer deposits remain flat, as lower current account volumes are offset by higher inflow in savings products.

Route24 strategy on track: remote advice is booming, 70% adopted digital banking

2022 was as a year of transition for ING Belgium in which the bank laid new building blocks to further roll out its Route24 strategy to make banking simple again.

ING resolutely built on the momentum of its new strategy in 2022 and is reaping the benefits on a commercial level. Digital and remote banking are fully acknowledged as the new normal and continue their upward trajectory. Our staff have worked hard to significantly improve the user experience in our ING Banking app. We have continued to optimise our branch footprint, consisting of both statutory branches and independent agents and have invested in larger branches. In so doing, we offer our private and corporate customers more specialised advice, better expertise and more comprehensive support. The choices we made have proven to be the right ones. Peter Adams, CEO of ING Belgium.

- 1.5 million customers use the ING Banking app on a daily basis. In 2022, ING Belgium recorded a record 673 million user sessions, a 10% increase vs. the previous year. The number of primary mobile customers increased also: +4%.

- New services were made available in the ING Banking app during the second half of the year. Customers can now change mandates or standing orders, or modify payment limits. This led to a 20% increase in the use of digital channels. In addition, new products were made digitally available: take out home and/or family insurance, or open an Easy Invest account.

- The number of contactless Bancontact payments rose to 166 million in 2022, 18% more than over the previous year.

Remote banking continues to grow in 2022. Our further investments in video advice have led to a marked increase in the number of video calls, with an average of 1,700 per month. Video advice on mortgages is in high demand.

The fact that we can put customers who want a home loan in touch with a mortgage advisor within 24 hours allows us to drastically reduce the processing time of an application file, to the customer’s satisfaction. Peter Adams.

Customers are making increasing use of the chat function: today it already represents more than 15% of all customer service interactions, double the number of interactions in 2021. Of all chat conversations, a quarter are managed by the ING digital assistant (Ida), which is constantly fed via artificial intelligence.

2022, breaking records on sustainable financing

The uncertainty with respect to energy supply in 2022 and climate change was a strong wake-up call for many private and corporate customers to accelerate the transition to a low-carbon economy. Regulatory requirements are becoming stricter and high energy bills are pushing customers to take action. ING Belgium has been playing a pioneering role in this field for years, facilitating the transition with tailor-made solutions and guidance to help customers address these challenges and identify the risks. ING offers multiple solutions for investing in sustainability.

- In 2022, the number of sustainable lendingtransactions for corporations increased by as much as 63% compared to 2021. Also in 2022, ING Belgium launched 3 Sustainable Improvement Derivatives (SID): a financial incentive for corporate customers to become more sustainable (ESG). The applicable interest rate spread is linked to the customer’s performance in terms of previously agreed sustainability improvements (KPIs).

- Private individuals who consider buying energy-efficient homes propelled the eco-renovation loan to unprecedented heights. Eco-renovation loans already represent 20% of the total consumer lending portfolio. The number of customers who took action to make their homes more sustainable more than tripled compared to 2021; the lending volume increased even further, almost quadrupling.

- In the field of mobility, too, the turnaround has clearly begun. Loans for vehicles with a good eco-score increased by 70%.

- In addition, ING Belgium recently launched an eco-mobility loan covering all mobility needs: car plus bike and, if desired, all necessary peripherals or accessories (e.g. charging station, bike carrier). ING offers the second-best interest rate on the market.

And finally, ING is pleased that after years of very low interest rates, its customers will be able to enjoy more attractive interest rates on savings products in 2023. We have recently announced a substantial interest rate increase, which has propelled the bank to the top of the savings market.

2022 was an atypical year, but we managed to post a solid result. In 2023, we will continue unabated with our strategy to make banking simple again. In the same way that the covid pandemic accelerated digital banking, the energy crisis has put sustainable business at the top of the agenda. Nevertheless, we still see unsure customers doubting about the choices they need to make with an eye to the future. It is up to us to turn those doubts into action and assist them with our expertise and tailored advice. Peter Adams.

20230202 - ING FYR2022 - press release - EN.pdf

PDF - 379 Kb

%201.jpg)

%203.jpg)

%202.jpg)

%201.jpg)