ING Belgium accelerates growth with record fee income, delivering pre-tax profit of €865 million

Strong commercial growth and deepened customer relationships are the drivers behind ING Belgium’s 2025 performance

ING Belgium reports strong commercial growth in 2025, marked by record fee income. These results reflect deeper and broader customer relationships and demonstrate our ability to diversify income streams. With a robust solvency position and a focus on efficiency, we remain committed to financing the growth and transition of the Belgian economy.

Peter Adams, CEO ING Belgium: “Our ‘Together for Progress’ strategy is delivering results. In 2025, we built deeper and more sustainable relationships with our customers, which translated into strong commercial performance. We remain a key credit engine for the Belgian economy, ensuring that financing continues to flow to entrepreneurs, even in challenging times. Looking ahead, we will continue to use our strong balance sheet to support projects vital to the future of the Belgian economy."

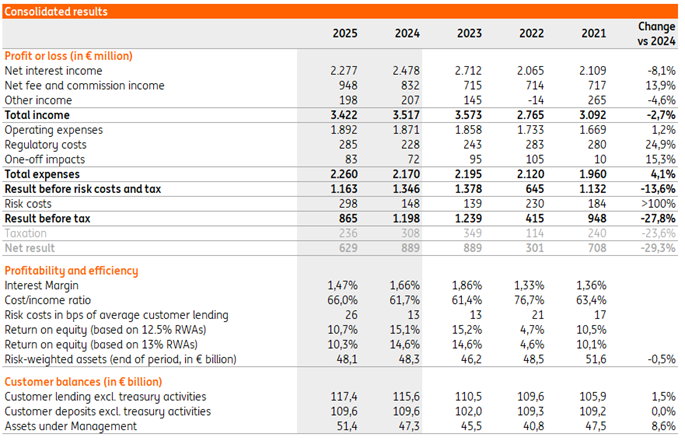

ING Belgium ended the 2025 financial year with a pre-tax profit of €865 million. This profitability is sustained thanks to a strong commercial activity, which pushed the fee income generating activities to record high levels. The decrease in pre-tax profit, compared to 2024, is mostly attributable to (1) reduced interest rate revenues in ING Luxembourg and the broader lower rate environment, (2) a significant rise in bank levies and (3) an increase in risk costs situated in the international part of our Wholesale Banking activities.

Income base diversifies thanks to exceptional fee income growth

Total income reached €3,422 million, maintaining the strong performance of recent years. Our depth of relationship with customers has resulted in a notable growth of close to 14% in fee income.

Interest income dropped to €2,277 million. This was mainly due to the overall lower interest rate environment and reduced revenues from our Luxembourg operations, where we are phasing out mass retail activities to refocus our activities on Private Banking & Wealth Management and Wholesale Banking.

Fee and commission income reached a record level of €948 million, now representing 28% of our total income base. This was driven by increased activity in investment products, higher sales of insurance products across the Private Individuals, Private Banking and Business Banking segments, and increased activity within the Financial Markets department of Wholesale Banking.

Costs under control, risks manageable thanks to strong balance sheet

As in recent years, we have kept cost growth below inflation and indexation, maintaining a nearly unchanged cost base of €1,892 million year-on-year. This contrasts with the rising trend on bank levies which weighed on the cost/income ratio in 2025.

Risk costs rose to €298 million. The increase in risk costs is situated in the international part of our Wholesale Banking activities, where we offer among others working capital solutions for large international corporates and act as a centre of expertise within ING Group. The cost of risk in our domestic activities remains at historic low levels both for private individuals and business customers.

Hans De Munck, CFO ING Belgium: "The elevated risk costs stemming from the international part of our Wholesale Banking activities remind us of the importance of strong underlying profit and capital generation. From that angle it is good to see that we are successfully accelerating growth in the further diversification of our income base, with a significant 13,9% annual growth in fee income. Our long-term strategy of efficiency and deepened customer relationships is paying off.”

Strongest commercial momentum in all business lines

Despite operating in a challenging geopolitical and macro-economic environment, we continued to prioritize the real economy in 2025. This becomes visible in our commercial strength. Commercially, 2025 was an exceptionally strong year marked by accelerated customer growth. This commercial momentum is visible across all segments:

- Business Banking generated a 21% increase in new customers and record-breaking business deposits. A key standout was business lending, where we outpaced the market average, making it our strongest growth area. This momentum, driven by the acceleration in volumes, solidifies our position as a primary engine for financing projects critical to the Belgian economy.

- Private Banking saw a sharp acceleration in growth as the net inflows increased significantly. While deposits remained stable on the liability side, a strategic focus on investment solutions led to a significant 8.5% increase in Assets under Management. These results reinforce our position as a premier investment house and a trusted reference in the market.

- Private Individuals remained firmly in a growth phase, bolstered by increased cross-selling, particularly within insurance and consumer finance. These results highlight our success in meeting a broader range of customer needs through a more integrated product offering.

Strategic outlook 2026: Sustaining momentum and accelerating growth

Looking ahead, we remain a stable and dependable partner for our customers. Despite an uncertain economic climate and geopolitical challenges, we are firmly ‘open for business’. We have the capital, profitability and risk appetite required to sustain our commercial momentum and continue supporting the real economy.

Innovation is fully embedded in our way of working. The integration of advanced digital tools into internal processes allows us to deliver greater expertise and more specialized propositions to our customers.

Peter Adams, CEO ING Belgium: “Our ambition for 2026 is to accelerate the progress achieved over the past years. By combining operational stability with continuous innovation, we remain highly confident in our differentiated expertise and superior digital proposition. We will continue to build on these foundations to drive growth and support our customers in an evolving landscape."

Peter Adams, CEO ING Belgium

Hans De Munck, CFO ING Belgium

Daphne Poets

Over ING

ING Belgium is een universele bank die financiële diensten aanbiedt aan particulieren, ondernemingen en institutionele cliënten. ING Belgium S.A./N.V. is een dochtervennootschap van ING Group N.V. via ING Bank N.V. (www.ing.com).

ING is een wereldwijd actieve financiële instelling met een sterke Europese aanwezigheid, die bankdiensten aanbiedt via haar dochteronderneming ING Bank. De doelstelling van ING is: mensen in staat stellen om een stap voor te blijven, zowel zakelijk als privé. De meer dan 60.000 medewerkers van ING bieden particuliere en zakelijke bankdiensten aan klanten in meer dan 100 landen.

Aandelen ING Groep zijn genoteerd aan de beurzen van Amsterdam (INGA NA, INGA.AS), Brussel en aan de New York Stock Exchange (ADRs: ING US, ING.N).

ING streeft ernaar om duurzaamheid centraal te stellen bij alles wat we doen. Ons beleid en onze acties worden beoordeeld door onafhankelijke onderzoeks- en ratingbureaus, die jaarlijks updates geven. De ESG-rating van ING door MSCI werd in augustus 2024 voor het vijfde jaar herbevestigd als 'AA'. Sinds december 2023 is het beheer van materiële ESG-risico's door ING volgens Sustainalytics 'Sterk'. Onze huidige ESG Risk Rating is 17,2 (Laag risico). Aandelen van ING Groep zijn ook opgenomen in belangrijke duurzaamheids- en ESG-indexproducten van toonaangevende aanbieders. Enkele voorbeelden zijn Euronext, STOXX, Morningstar en FTSE Russell.

%2007-03-2022-1%20crop.jpg)

%2007-03-2022-1.jpg)