ING Belgium : 2013 financial and commercial results

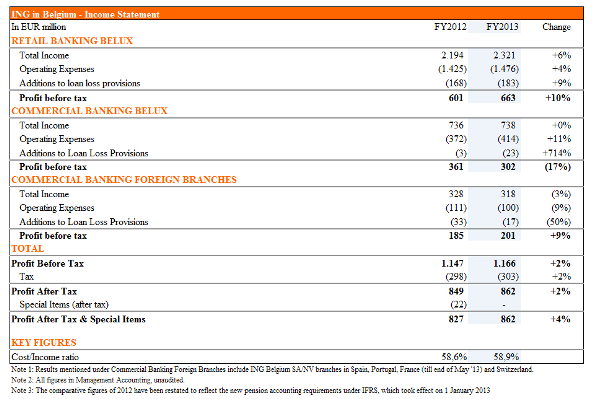

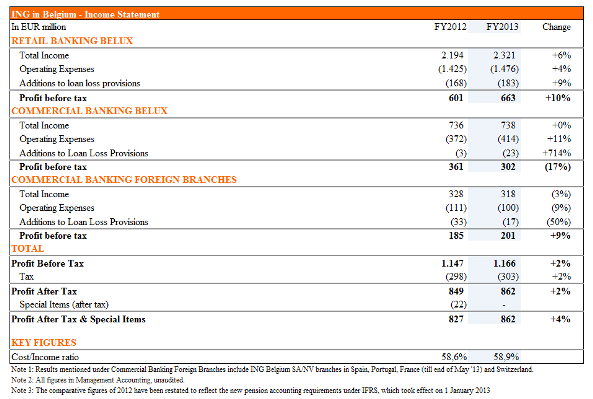

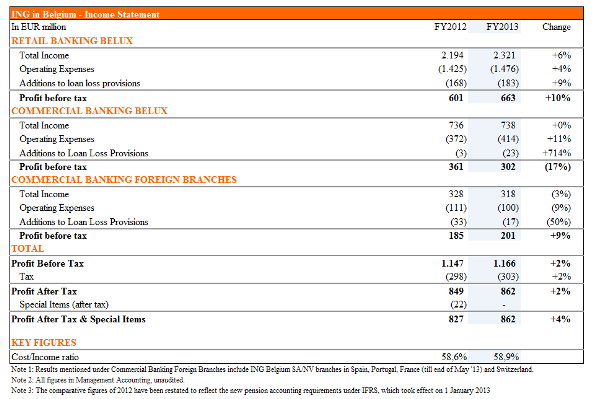

ING in Belgium posted a profit before tax of EUR 1,166 million, compared to EUR 1,147 million in 2012 (+2%). The increase in profit was a result of the successful execution of ING’s commercial strategy ‘direct if possible, advice when needed’, and disciplined management of costs.

PRESS RELEASE

Brussels, 20 Februari 2014

'Direct if possible, advice when needed’ leads to solid results

- Profit before tax at EUR 1,166 million.

- Net growth of 500,000 active clients since 2007, of which 62,000 gained in 2013.

- ING actively supports the real economy.

- ING Belgium is a large tax contributor with EUR 294 million paid in income taxes and a total tax contribution of EUR 1,013 million generated by its activity.

- The new Collective Labour Agreement (CLA) offers a solid platform to focus on the future together with employees.

ING in Belgium(1) posted a profit before tax of EUR 1,166 million, compared to EUR 1,147 million in 2012(2) (+2%). The increase in profit was a result of the successful execution of ING’s commercial strategy ‘direct if possible, advice when needed’, and disciplined management of costs.

The net growth in active clients in 2013 amounted to 62,000, bringing net growth in active clients since 2007 to 500,000. ING Belgium won the ‘Bank of the Year 2013–Belgium’ award from The Banker magazine, confirming its leading position as a client-focused bank.

Rik Vandenberghe, CEO of ING Belgium: “With our easy online services and personal advice, we offer our clients the best of both worlds. I am very proud of ING, of our results and of what our employees have achieved for our clients.”

The net growth in active clients in 2013 amounted to 62,000, bringing net growth in active clients since 2007 to 500,000. ING Belgium won the ‘Bank of the Year 2013–Belgium’ award from The Banker magazine, confirming its leading position as a client-focused bank.

Rik Vandenberghe, CEO of ING Belgium: “With our easy online services and personal advice, we offer our clients the best of both worlds. I am very proud of ING, of our results and of what our employees have achieved for our clients.”

***

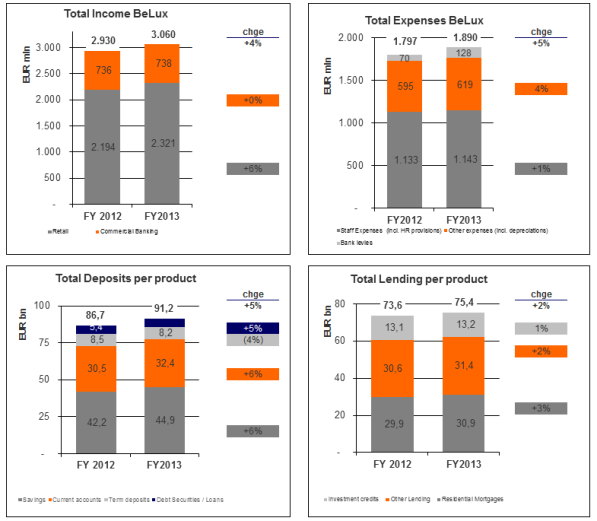

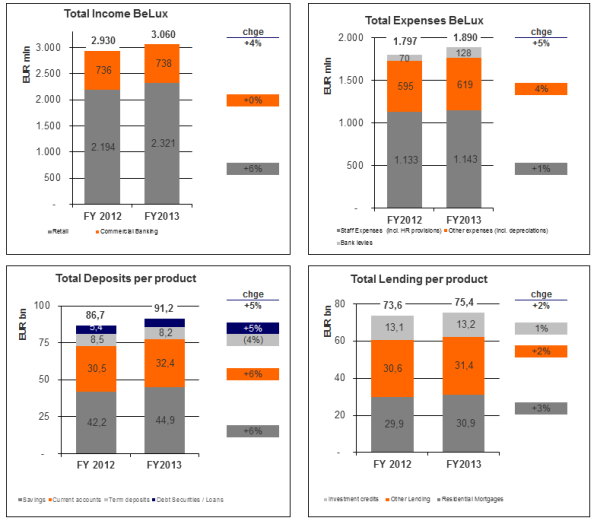

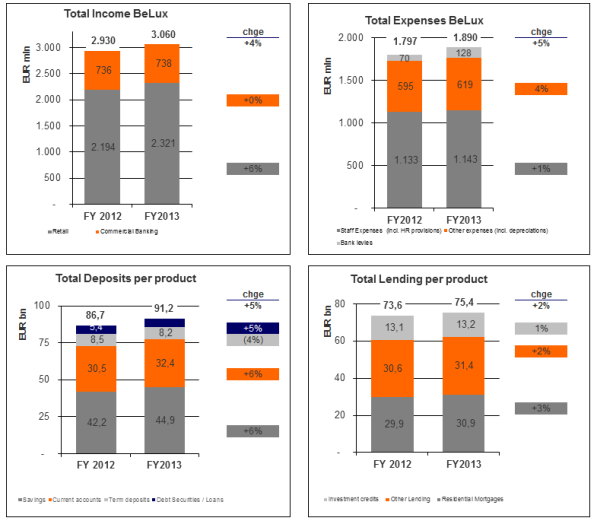

ING’s steadily growing customer base and the success of the ING Lion Account resulted in EUR 4.5 billion (+5%) additional deposits (savings and current accounts) in 2013. More than a 100,000 ING Lion Accounts, ING’s free online current account, were opened in 2013.

The lending portfolio increased by 2.5% driven by mortgages and Project Finance. Long-term lending increased by 4% compared to year-end 2012. Compared to 2009, the total lending portfolio has grown by 33%. The increased lending levels demonstrate ING’s commitment to supporting the real economy. ING is an important tax contributor with EUR 294 million paid in income taxes in 2013 and a global tax contribution of EUR 1,013 million generated by its activity.

Income BeLux grew by 4% compared to 2012:

- In Retail Banking (including Private Banking, Midcorporates & Institutionals), total income grew by almost 6% to EUR 2,321 million. This reflected higher commission income as well as higher net interest income. The successful transformation of the branch network continued. More than 600 out of 748 branches have now been completely refurbished into more open and client-friendly branches. In 2013, ING made personal advice easier: clients can receive advice from ING’s specialists and sign for advice-related products such as investment or lending products anywhere, for example at home. The new ING Smart Banking app for tablets, which was launched in September, was very well received by our clients. ING’s Smart Banking applications for smartphones and tablets have been downloaded 448,000 times since 2011.

- Private Banking has a top three position in Belgium. Assets under management in Belgium were up 7.2% or EUR 1.3 billion to EUR 18.7 billion. With the launch of the new Private Banking interface on ING Smart Banking (2014), Private Banking clients can now easily view their investments on tablet.

- Key deals with institutional clients in Lending and Financial Markets resulted in a 5% income increase for Midcorporates & Institutionals. Market surveys show that one in three family-owned companies name ING as their main bank.

- In Commercial Banking, total income is stable year-on-year (at EUR 738 million), as 2012 figures included significant capital gains due to de-risking activities. However, the income from underlying business activities (especially Project Finance and Financial Markets) showed substantial growth.

***

Expenses BeLux increased by 5% compared to 2012. This is due to higher bank levies and the exceptional human resources provisions in the context of the new Collective Labour Agreement. Operational costs were under control. Internal and external staff expenses decreased whereas costs related to investment programs were higher.

The slight increase in additions to loan loss provisions reflected a still weak economy.

ING Belgium (SA/NV) maintains a high solvency, with a pro-forma Tier 1 ratio of 17.7% (Basel III definition).

***

ING Belgium concluded a new Collective Labour Agreement (CLA) in 2013 with its social partners. It offers a well-balanced agreement allowing ING to look to the future with its employees. The new CLA moderates the rise in salaries until 2016 and focuses on employability.

Between the end of 2012 and 31 December 2015, the total number of FTEs at ING Belgium will fall by 1,115 FTEs. This stems from clients’ increased use of online and mobile banking and the need for an additional focus on costs. However, with the natural outflow expected to be higher in this timeframe, the bank will continue to recruit in the labour market. In 2013, 314 FTEs were recruited at ING.

Please find here the presentation on ING's 2013 financial and commercial results, shown during the press conference.

(1) ‘ING in Belgium’ includes the ING entities active in banking and leasing in Belgium & Luxembourg (called BeLux ) and the French (till May 2013), Spanish, Portuguese and Swiss branches of ING Belgium SA/NV. The latter are called Foreign Branches in what follows.

(2) Comparative figures 2012 restated to reflect the new pension accounting requirements under IFRS, which took effect on January 1st, 2013.

_____________________________________________________________________________________

For further information :

Press office ING Belgium, tel +32 2 547 24 84, pressoffice@ing.be