Half-year results 2021: ING Belgium posts strong pre-tax result of almost 350 million euros

Digital banking continues to grow with nearly 40% more app visits and best scores yet from customers

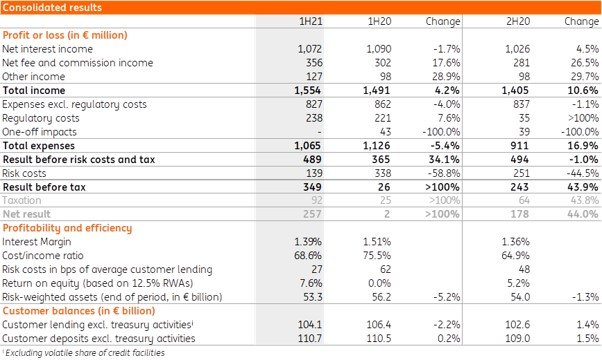

Friday 6 August 2021 - Brussels - ING Belgium, which will be celebrating its 150th anniversary this autumn, posts a pre-tax result of €349 million for the first half of 2021. Total income is up by €63 million thanks in part to higher revenue on investment products. Risk costs are down to €139 million, a 60% decrease compared to the same period in 2020. ING issues also 40% more mortgage loans in the first 6 months of 2021 compared to the same period last year. Between January and June, digital and remote banking continue to book strong growth with nearly 40% more visits to the app. The ING Banking app receives a record satisfaction score from its customers: 4.1 for iOS and 4.5 for Android.

The impact of the coronavirus could still be felt during the first 6 months of 2021. ING remains committed to support private individuals, companies and entrepreneurs in these challenging times. This also applies to customers who fell victim to the recent unprecedented severe weather in the south of the country. The bank is currently putting everything in place working to provide tailored support to those affected.

Despite this eventful half-year, ING Belgium delivers a strong result. The bank reports a pre-tax result of €349 million. This is considerably higher than the same period last year, when a pre-tax result of only €26 million was recorded.

"ING Belgium capitalised on the recovery of the Belgian economy with a strong commercial result in the first half of 2021. Income is 4.2% higher than in the same period last year. Strong growth in commission income was able to offset declining interest income. Our continued cost discipline and drive for efficiency further contributed to the higher profit."

Hans De Munck, CFO ING Belgium

Income increases by more than 60 million euros

Total income rises by €63 million compared with the first half of 2020, mainly thanks to higher commission income from investment products and current accounts. The lower interest income is driven by lower income from savings and current accounts as a result of the low interest rate environment. This decrease is partly offset by temporarily favourable funding conditions from the European Central Bank (TLTRO1).

Excluding bank levies, expenses continued their downward trend and amounted to €827 million, 4.0% lower than last year. The decline is the result of continued cost discipline coupled with reduced staff expenses. Risk costs amounted to €139 million. Although still at the upper end of the long-term average, risk costs decreased by €199 million compared to the same period last year as the economy slowly recovers from the coronavirus crisis.

More people are knocking on the bank's door to buy a home: 40% more mortgage loans

In the first half of 2021, ING in Belgium issued €9 billion in new loans. As a result, the outstanding loan portfolio increases by €1.5 billion compared to December last year. Customer deposits increased by €1.7 billion compared to December, mainly on current accounts.

"Our customers are still finding their way to our bank for important moments in their lives. For example, we granted 40% more mortgage loans compared to the first 6 months of last year. In addition, assets under management in investments increased by 11% since the beginning of the year, partly due to low yields on savings accounts. Also noteworthy is that more companies are taking out green loans, with the ambition to achieve their sustainability goals. The deals with AB InBev and Montea are good examples of this."

Hans De Munck

New records for ING Banking app: nearly 300 million visitor sessions and top customer scores

Nearly 2 million customers now use their smartphone or computer to do their banking. The high number of digital banking users is a direct result of the bank's continued investments in making digital and remote banking as easy as possible. An increasing number of customers request remote advice from ING experts via video call, for example in relation to mortgage loans and investments.

In the first 6 months of 2021, 15% more customers actively managed their banking online; in the case of the app, user numbers increased by 9%. The app is opened more than 1.5 million times every day and receives almost 300 million visits in the first half of the year. That is a 38% increase compared to the same period last year.

ING has launched several new features in the app, all aimed at simplifying banking:

- Chat: almost 360,000 customers can now ask questions via chat. The feature is particularly popular amongst young people, with the number expected to rise even further in the coming months.

- Authenticated calls: customers can now call customer service via the app and be immediately and automatically identified. As a result, they can get the help they need in a more personal, quick and efficient way.

- OneView: this smart subscription manager can save customers an average of €400 a year. In just 3 months' time, the service already has nearly 25,000 users.

- Payconiq: app users can now pay their phone contacts (back) immediately and remotely via a shared link, WhatsApp or QR code.

- ING+ deals: the number of partners in ING's cashback programme has been expanded to include among others the supermarket chain Delhaize, the Belgian clothing brand Xandres and the Belgian start-up webshop BelConso. Customers who signed up received an average of €25 credited back to their account. More than 280,000 customers now use this service.

New services will be introduced over the next 6 months aimed at making banking as simple as possible. For example, customers will be able to block their debit or credit cards, request documents such as repayment schedules and view the status of their mortgage loan directly via the app. In addition, a new digital solution for investments is also being developed.

"We continue to invest in digitalisation to be able to respond more quickly to customer needs, which are constantly changing. We have worked hard over the past 6 months to equip our app with new features. And it is nice to see that our customers are acknowledging our efforts by giving the app great scores, with a rating of 4.1 for iOS and 4.5 for Android, the best ratings yet for our app. We have achieved this thanks to the continuous integration of our customers' feedback and the impressive dedication of our teams. I look forward to welcoming all our Private Banking and Business customers to the app at the end of this year."

Peter Adams, CEO ING Belgium

Double the number of contactless payments, just before Apple Pay launch

Contactless payments have become significantly more popular since the start of the pandemic and this trend continues. No fewer than 63 million contactless payments were made with Bancontact in the first half of the year. This is more than double the number in the same period last year. With the launch of Apple Pay earlier this week, ING expects the number of contactless payments to increase even further.

ING Belgium launches new "hybrid" way of working on eve of 150th anniversary

In March, ING Belgium and the majority of its social partners signed new collective labour agreements (CLAs) which form the basis for a new future way of working. As of September2, the bank will introduce this new hybrid way of working for its employees who will then be able to work on average 50% of the time from home and the other half of the time at the office. At the same time, ING has made a decisive choice in favour of ‘combi-mobility’ with these CLAs: employees are financially compensated if they combine different means of transport when travelling between home and work. This is relevant in the context of the Brussels Region's plans to ban fossil-fuel car traffic by 2035.

"The conclusion of these collective labour agreements was a highlight of the first half of the year. They reflect ING's determination to be a responsible and modern employer. These agreements also include retraining and upskilling so that employees can keep up with society's fast-changing digital evolutions."

Peter Adams

The next 6 months will also be marked by the bank's 150th anniversary on 13th November. Plans for celebrating the anniversary are currently in full swing.

"The evolution of this bank is impressive: from the Bank of Brussels founded in 1871 to ING Belgium today. This bank has always had a great social responsibility and is firmly rooted in our Belgian economy. We are very proud of this. One constant in our long history is that for 150 years now we have enabled people to realise their plans and dreams and have supported entrepreneurs in building their businesses - both big and small, nationally and internationally. That is what we stand for and will continue to stand for."

Peter Adams

1 TLTRO or ‘Targeted longer-term refinancing operations’

2 Subject to the evolution of the spread of the coronavirus