Full Year 2020 results: ING Belgium posts profit while increasing loan loss provisions

Record year for digital and remote banking: 25% more app visits, 15% more customer calls and almost three times more contactless payments

Friday, 12 February 2021 - Brussels - ING Belgium posted a pre-tax result of €269 million in 2020, while increasing loan loss provisions. Anticipating that companies will continue to suffer from a weakened economy, the bank increased its provisions for potential credit losses by €589 million. As part of the crisis support measures, ING helped thousands of families and businesses in Belgium by granting payment holidays for a total outstanding amount of almost €8 billion. The pandemic has led to an increase in deposits to an amount of €109 billion. At the same time, demand for new lending was subdued but nevertheless new loans amounting to €14 billion were provided. The bank’s capital ratios and liquidity buffers were also further strengthened in 2020, well above the regulatory requirements. Last year, ING also set a number of new records in digital and remote banking. Throughout the past year, customers increased their usage of the ING app by 25%. The number of cashless payments almost tripled to more than 80 million. The bank also processed around 15% extra customer calls which is almost 3 million per year or an average of 12,000 per day.

Like everyone, ING in Belgium has had an unusual year. In March 2020, more than 7,500 employees switched to working from home because of the outbreak of the Covid-19 pandemic. Within 48 hours, ING became the first bank in Belgium to manage this unprecedented operation. While adapting to the security measures as protection against the Covid-19 virus, the bank nevertheless remained fully operational: ING continued to assist its 3 million customers remotely and branches remained accessible by appointment. The investments made in recent years in “agile” working, working from home and digitisation paid off. 2020 also boosted the growing trend of digital banking, remote banking and digital payments.

25% more visits to the ING app in 2020

ING in Belgium continuously analyses its customer preferences and the changing nature of interactions in order to optimise the mix of its physical and digital offerings to provide the best possible customer experience. In the past year ING has invested in digital remote advice capabilities to ensure the availability of expert advice at the convenience of its customers.

By the end of 2020, nearly 1.8 million ING customers managed their banking online or via the app (an increase of 53,000 or 3% compared to 2019). That is more than half of all ING customers. The number of visitor sessions on the app also set a new record: over 511 million. If we compare that figure to 2019, it is a 25% increase (over 408 million app visits). Moreover, more customers use the app for their banking than online via computer.

Last year, ING in Belgium started rolling out "One View" in the app. This application allows customers to manage their subscriptions. For example, if they no longer want a particular subscription, the bank can stop these free of charge without them having to do all the red tape themselves. ING was the first bank in Belgium to offer this service. ING expects this subscription manager to save its customers over €15 million by early 2024.

The payment behaviour of ING customers has also changed significantly, breaking records for contactless payments. There were no fewer than 82 million contactless payments made via Bancontact in 2020, up from 29 million in 2019, which is almost a threefold increase. The number of cash withdrawals, on the other hand, fell by 35% compared to 2019. People are however withdrawing larger amounts: the average amount was €187 in 2020 (compared to €169 in 2019).

Customer service receives record number of calls in 2020

Last year, customer service received no fewer than 3 million calls: a record and an increase of 15% compared to the same period last year. That is an average of 243,000 calls per month or up to almost 12,000 calls per working day.

To further respond to the rising digital trend, the bank is working on applications that improve customer service. Since February 2021, a feature has been launched in the app that lets the customer service member know immediately which customer he or she is talking to thanks to automatic call authentication. This saves the customer valuable time as he or she no longer needs to identify themselves at the beginning of the call. Authenticated chatting with the bank via the app will also be rolled out in the spring of this year.

"The long-awaited migration to the new digital platforms (OneApp and OneWeb) for private individuals in Belgium is complete. We are now ready to connect our business customers to the new digital platforms. Our teams have worked hard to build a strong foundation. Now that we have all the components, we can build and launch innovative features and practical applications in the app faster. In addition, Belgium can now more easily implement innovations from other countries where ING is active to make banking even easier for our customers."

Peter Adams, CEO of ING Belgium

Impact of the pandemic on financials

The pandemic has an impact on the employment and financial situation of many people. Many are concerned about paying off their mortgage, loan or credit card debt. ING Belgium is doing its utmost to help its customers through these difficult times. Last year, for example, the bank helped families and businesses by granting payment deferrals for tens of thousands of loans with a total outstanding amount of almost €8 billion. This is part of the federal government deferral scheme for families and businesses, provided they meet certain conditions. In the meantime, the payment holidays for companies have been extended until the end of June 2021, and until the end of March 2021 for families.

The impact of the Covid-19 crisis has hit companies hard. Economic uncertainty remains in 2021 and the effects of the crisis will be felt for a long time. ING is ready to support the Belgian economy and to help ensure that the financial system remains healthy and sustainable.

Changing customer behaviour impacted both lending and deposits

In 2020, the lending portfolio excluding treasury-related activities ended at €102.6 billion1, which is €3.0 billion lower than in 2019. The decrease is mostly driven by family businesses and wholesale customers who became more prudent in their investment decisions in the wake of Covid-19, resulting in lower demand for loans. Total customer deposits ended at €108.9 billion in 2020, which is an increase of €3.7 billion compared to 2019. The growth is mostly driven by private individuals and family businesses, as they are saving more and spending less during this crisis.

€269 million in profit before tax

The Covid-19 crisis has also affected the bank’s financial results. In 2020, ING Belgium reported a pre-tax result of €269 million (€351 million excluding €82 million related to an impairment and one-off transformation costs). In 2019, ING Belgium reported a pre-tax result of €805 million.

“During 2020, the pandemic caused customers to entrust more deposits with us, while the demand for lending decreased. This changing mix causes our interest rate result, which was already under severe pressure from continued negative interest rates, to decrease versus last year. This effect was only partially compensated by increased fee and commission income, which benefited from increased turnover in investment products but lower transactional fees stemming from lower economic activity.”

Hans De Munck, CFO ING Belgium

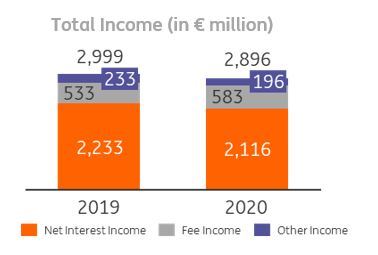

Commission income grew by 9% compared to previous year, however total income is lower

Despite the slowdown in the economy, ING Belgium managed to grow its commission income by more than 9% in 2020. The strongest growth came from investment products and current accounts.

Interest income on lending products also showed an increase compared to 2019. However, as loan growth was sluggish during 2020, this did not offset the lower interest income from savings and current accounts due to the low interest rate environment. Other income is down on previous year, mainly driven by treasury-related activities and Financial Markets, where market volatility negatively impacted income. Consequently, total income in 2020 decreased by €103 million when compared to 2019, which is a drop of about 3%.

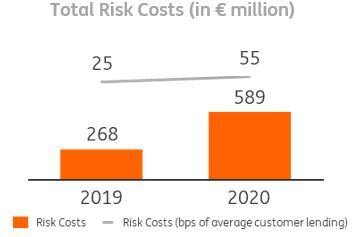

Risk costs doubled due to Covid-19 crisis

In 2020, ING Belgium reported €589 million in risk costs (corresponding with 55 basis points of average customer lending), which is significantly higher than 2019 when €268 million risk costs were booked. The increase is a direct result of the Covid-19 crisis.

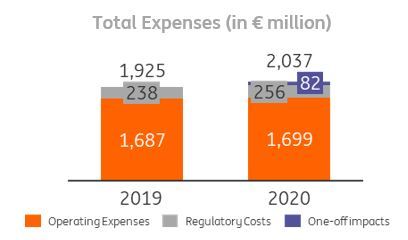

Operating expenses are stable in 2020

The presented expense base contains €82 million incidental items related to an impairment and transformation programs. Excluding these incidental items, operating expenses increased by less than 1% (€12 million) compared to last year. Benefits coming from a more efficient use of the bank’s various distribution channels are more than offset by higher expenses to keep the bank safe and compliant (Know Your Customer). Furthermore, bank levies increased by €18 million, resulting in a total underlying cost base of €1,955 million in 2020, which is 1.6% higher than 2019.

Conclusion

"As the new CEO of ING Belgium, I am committed to supporting our entrepreneurs and companies in these challenging times. We will continue to help our customers and address their liquidity needs so they can lead in the rebound of our economy. We will also help our customers navigate through more structural challenges so they can strengthen their capital position. In parallel, we will focus even more on the accelerated digitalisation of our products and services, because customer behaviour continues to change at lightning speed. An even stronger focus on digital solutions within ING will ensure that we actively create more time and space for tailored customer advice. As our customers’ business partner, we must not only keep up in shaping their digital experience, but also have the healthy ambition to lead in this course."

Peter Adams, CEO of ING Belgium

1 Excluding volatile share of credit facilities

20210212 PRESS RELEASE ING BE FYR2020.pdf

PDF - 222 Kb

Press Office ING Belgium