A first on the market: ING Belgium innovates with ‘ING Scan & Drive’

AI-driven calculation tool estimates car loan and insurance costs on the basis of a single photo

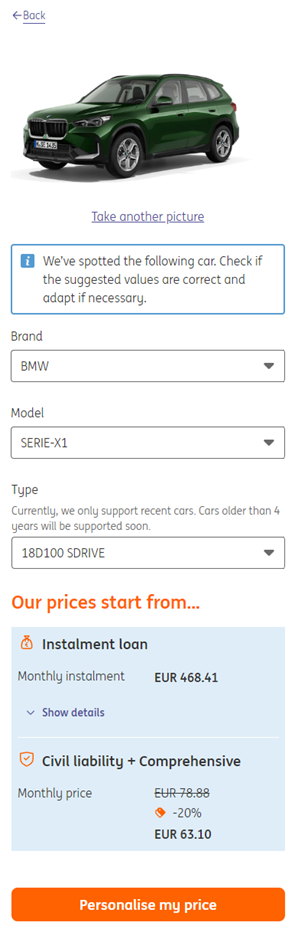

Brussels – Hybrid, electric or a combustion engine? Looking for a new or used car can be quite a task. However, getting an estimate for a car loan and insurance is not. With ‘ING Scan & Drive’, ING Belgium is launching an intuitive tool which calculates the price almost immediately after the customer has uploaded a single photo of a car. It estimates both the insurance premium and the car loan. A first on the Belgian market.

Sali Salieski, Head of Retail & Private Banking at ING Belgium: “We are very proud to have developed ING Scan & Drive, together with our insurance partner NN. This is an innovation, first of its kind on the market, and this is once again an example of delivering a simple, modern technology enabled unique customer experience. In addition, we’re leveraging to our strengths providing a bank-insurance product meeting the customer needs in one place.”

AI-driven technology

If you want to put the tool to the test, go to ing.be/en/scandrive

- Click on “Take your picture” and take a photo* of your dream car.

- Receive immediately an estimate for the car loan and insurance costs. This is based on data extracted by Open AI, such as the brand, model and type of car.

- Personalise your calculation by entering your age, address (postal code and city) and loan term, in addition to your preferred insurance cover.

- Looks good? As an ING customer you can immediately sign up online for a car loan and insurance.

You can currently use ‘ING Scan & Drive’ for new cars. You’ll soon be able to use the tool for second hand cars too. Curious? Scan the QR code and test it out!

* It is important to take a photo that shows both the front and side of the car, as in the illustration hereunder.

About ING

ING Belgium is a universal bank that offers financial services to private customers, companies, and institutional clients. ING Belgium SA is a subsidiary of ING Group SA, via ING Bank SA (www.ing.com).

ING is an international financial institution with a strong European presence and offers banking services through its operating company, ING Bank. ING’s goal is to ensure that everyone is always one step ahead in both their private and professional lives. With more than 60,000 employees, ING provides retail and corporate banking services to the bank’s private customers in more than 40 countries.

ING Group shares are listed on the stock exchanges of Amsterdam (INGA NA, INGA.AS), Brussels and New York (ADR: ING US, ING.N).

Sustainability is an integral part of ING’s strategy, as evidenced by ING’s leading position in industry benchmarks. ING’s Environmental, Social and Governance (ESG) rating by MSCI was confirmed to be “AA” in July 2023. Since December 2023, Sustainalytics has considered ING’s management of material ESG risks to be “strong”. ING Group shares are also included in the leading sustainability and ESG index products of leading providers Euronext, STOXX, Morningstar and FTSE Russell.

Additional information:

Gianni De Muynck