2021 full-year results: ING in Belgium sees revenues rise above €3 billion and posts nearly €950 million profit

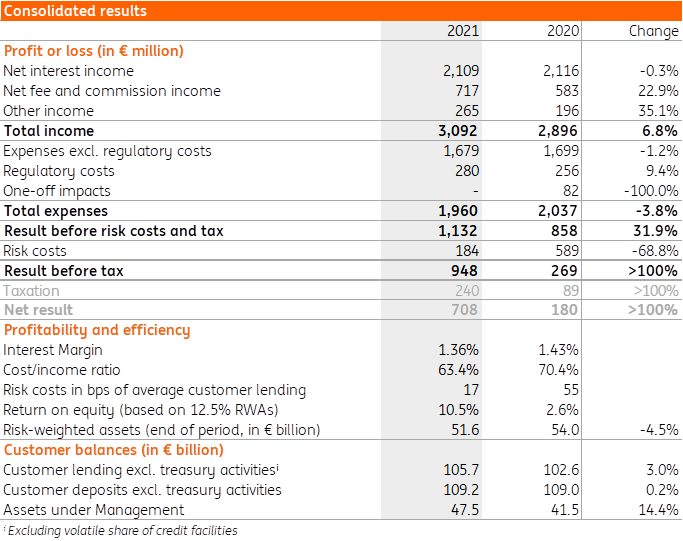

Thursday 3 February 2022 - Brussels - ING in Belgium posted a pre-tax result of €948 million in 2021, almost four times the previous year's figure. A strong increase in revenue from investment products pushed income above €3 billion. Last year’s gradual economic recovery was reflected in an almost 70% reduction in risk costs and a growing loan portfolio. In 2021, the bank granted €16.7 billion in loans. Residential loans rose by more than 35%. ING also recorded a three-fold increase in the volume of sustainable loans granted to large companies. Digital and remote banking continued to grow with just under 13% more visits to the ING Banking app. Nearly 7 out of 10 ING customers in Belgium now do their banking digitally.

2021 was a special year for ING in Belgium. The bank celebrated its 150th anniversary and outlined a new strategy for the coming years in which simplifying is key. This new direction is also reflected in the bank’s financial and commercial results.

"Last year was the perfect time for this bank, which has been anchored in the Belgian economy for a century and a half, to write a new chapter in its story. We have worked very hard with our teams to map out a new strategy for 2024, which focuses on making banking simple and straightforward for our customers. I am proud that we are seeing the first fruits of those efforts in our figures today. The work is certainly not finished. We will continue to invest in order to simplify our product range and to be able to anticipate digitalisation more quickly. This will enable us to focus in 2022 and in coming years on the expertise and service that customers expect and deserve from us."

Peter Adams, CEO of ING in Belgium

Despite the ongoing coronavirus pandemic, the Belgian economy is gradually recovering and ING in Belgium managed to post a strong result in 2021. The bank is reporting a pre-tax result of €948 million. This is almost four times higher than for 2020, when a pre-tax result of €269 million was recorded.

ING in Belgium ends 2021 with €3.1 billion in revenue

Total income rose by €196 million compared to 2020, mainly due to 23% higher commission income from investment products and accounts. Although interest income continues to decline due to the lower interest rate environment, the selective negative interest rate charge on deposits and temporary favourable funding conditions from the European Central Bank (TLTRO1) mitigated the decline in 2021.

Operating expenses continued their downward trend and amounted to €1,679 million, 1.2% lower than in the previous year. This decrease is the result of a continued focus on costs combined with lower staff expenses. The bank continues to take a cautious approach to loan impairments, with risk costs closing at €184 million, which is €405 million lower than in 2020, thanks to the gradual recovery of the economy.

“ING in Belgium has had a strong commercial year, which I'm pleased to see has translated into revenue growth of almost 7%. We closed with over €3 billion in income, fuelled by over 20% growth in commission income, which helped offset the decline in interest income. Continued cost discipline and lower risk costs also contributed to an outstanding full-year profit.”

Hans De Munck, CFO of ING in Belgium

Nearly a quarter more new loans granted

ING in Belgium issued €16.7 billion in loans in 2021, 28% more than in 2020. As a result, the loan portfolio increased by €3.1 billion compared to the previous year. This increase is mainly due to mortgage loans and loans to large companies. Deposits remained almost constant in 2021 as a notable portion was shifted to investment products and invested in the stock market, thus contributing to the growth of the assets under management.

“Our customers continue to find their way to ING for important moments in their lives. For example, we granted 37% more mortgage loans compared to 2020. Assets under management in investments also increased by 14% since the beginning of the year.In addition, in what was also the year of COP26, we saw more and more companies putting sustainability high on the agenda. ING played its part as a sustainability advisor and closed a record number of green or sustainability-linked transactions in 2021 with AB InBev, GIMV and Proximus, among others. This represented a loan volume of €1.4 billion over the course of 2021, more than triple the figure for 2020."

Hans De Munck

Nearly 7 out of 10 customers bank digitally, 12 times more remote advice sessions

As part of its new strategy, ING in Belgium invested heavily in 2021 to make digital and remote banking as easy as possible. For example, the bank launched remote customer advice for mortgages and investments in March, with great success. By the end of 2021, ING's experts were carrying out 12 times as many remote conversations per month as in the first months of the roll-out. Customers also awarded high satisfaction scores for this type of advice with an average rating of 9 out of 10.

The number of customers managing their banking via the app or their computer also continues to grow. In 2021, almost 7 out of 10 customers did their banking digitally, compared to “only” 50% two years ago. The app was opened more than 1.7 million times per day and in 2021, there were 615 million visitor sessions. That is an increase of 13% year-on-year.

“Millions of retail and business customers switched to the new ING Banking app last year. At the same time, we gradually added new features that make banking even easier. For example, customers can now block their debit and credit cards or change their legal address directly in the app. We also launched a chat function in the app. Our investments in digital development and the integration of feedback from our customers are paying off and resulting in great scores. We are keen to continue on this path in 2022."

Peter Adams

Other new features include automatic identification when calling customer services via the app. As a result customers can receive the help they need in a more personal manner that is quicker and more efficient. OneView, the first digital subscription manager, now with more than 32,000 users, is also a success. The ING+ deals cashback programme is the most used product in the app. Last year, for example, 153,000 users registered and ING returned a total of €586,000 in cashbacks. Cashbacks with supermarket chain Delhaize, clothing chain JBC and TakeAway, among others, are doing remarkably well during the Covid-19 pandemic. In total, 334,000 customers have already signed up for ING+ deals since the launch in 2018.

Contactless payments rise by nearly 70%

In 2021, Apple Pay joined the ING Banking app, further boosting contactless payments. ING also recorded no fewer than 137 million contactless payments via Bancontact, 68% more than in 2020. On the other hand, cash withdrawals continued to drop by 6% compared to the previous year.

Self Invest for both first-time and experienced investors

Given the continued low interest rate environment, Belgians are looking for alternative options for their savings. One answer is the ING Self Invest platform which the bank launched at the end of last year.

“This tool gives everyone the opportunity to invest digitally and easily, whether they are new or existing customers, small or large investors, experienced or inexperienced. ING offers customers a pre-selected range of products, such as interesting shares and funds, to help them choose from the very wide variety on offer.”

Peter Adams

To lower the threshold even more, the pricing has also been adjusted. For example, transaction costs with the ING Self Invest tool will fall by around 30% compared to the previous pricing. A new investor who takes his first steps on the stock market with €100 pays a transaction fee of €1.

150-year-old ING in Belgium becomes the first bank to conclude a CLA on a 'hybrid' way of working

ING in Belgium experienced several highlights in 2021, including the celebration of its 150th anniversary on 13 November with more than 7,000 employees. The bank also wanted to give something back to society as part of this anniversary and set aside half a million euros to give various public buildings a sustainability upgrade that should remove 1,500kg of CO2 from the atmosphere every year.

The bank also concluded new collective labour agreements (CLAs) with the majority of its social partners on the new hybrid way of working. Employees can work from home on average 50% of the time and spend the rest in the office. ING will continue the extensive renovation of its Marnix building this year and looks forward to welcoming its employees in 2023 to a C02-neutral environment that is fully adapted to the new way of working.

1 Targeted longer-term refinancing operations